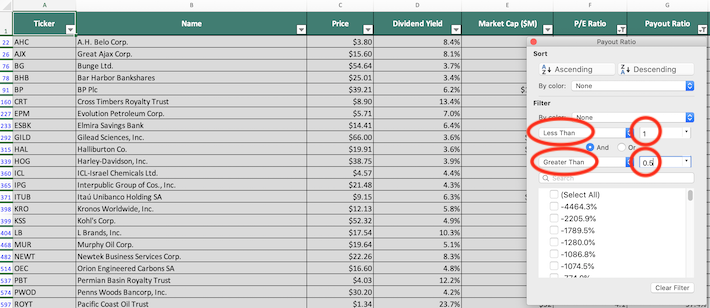

Dividend growth and high dividend yield. For example assume a company with a stock price of 50 pays a.

Why Do Companies Pay Dividends Yadnya Investment Academy

Why Do Companies Pay Dividends Yadnya Investment Academy

If a 100 million dollar company pays out 1 million dollars in.

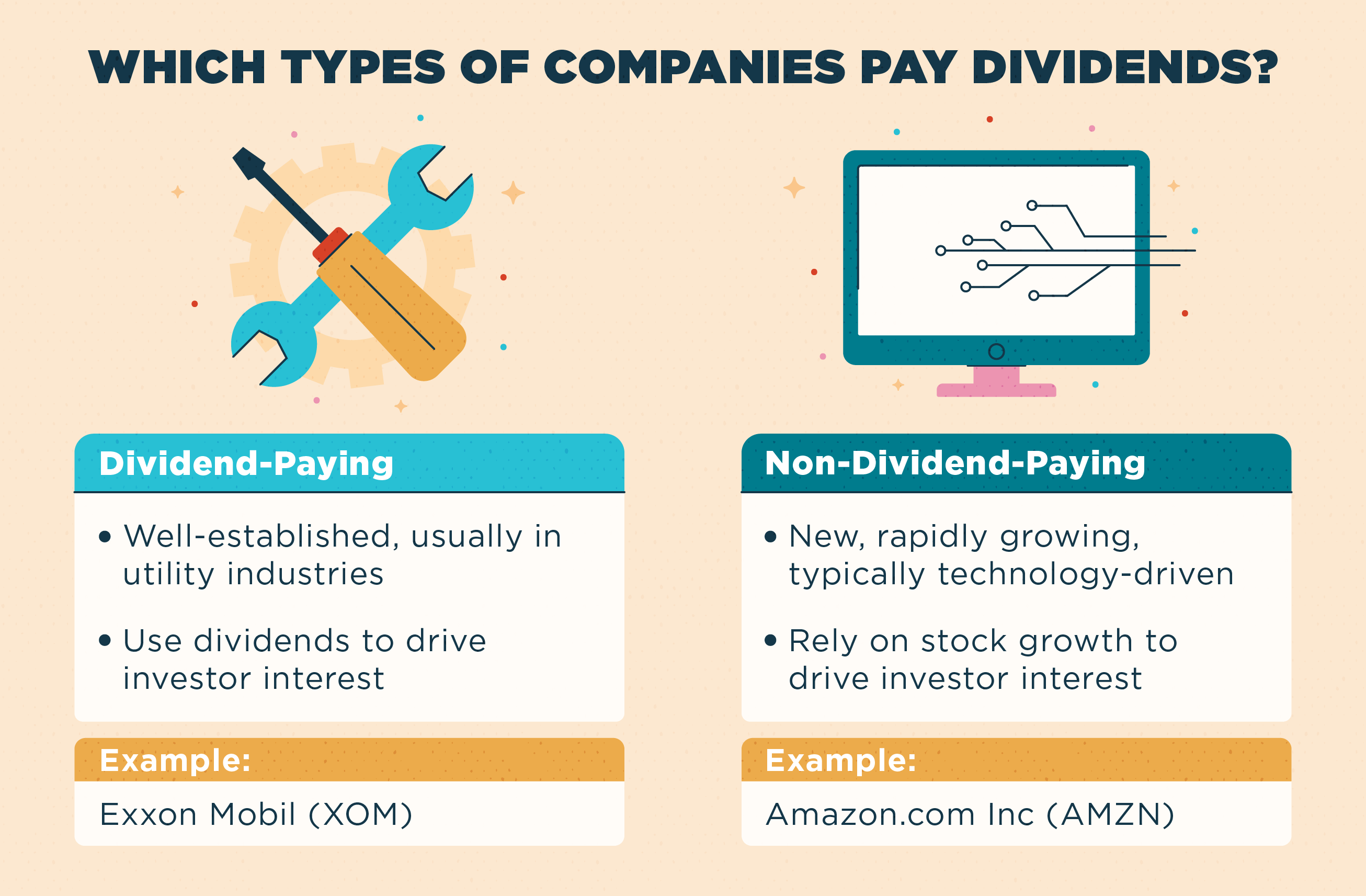

Why do some stocks pay dividends. So given that we know how to calculate how much a company is worth now we can start to see why a stocks price drops on ex-dividend date. However not all companies pay dividends. Typically companies that have consistently paid dividends are some of the most stable companies over the past several decades.

One of the simplest ways for companies to foster goodwill among their shareholders drive demand for the stock and communicate financial well-being and shareholder value. People buy stocks because there is more to Return on Investment than whether dividends are issued or not. Stock prices fall for many reasons.

A corporation might declare a stock dividend instead of a cash dividend in order to 1 increase the number of shares of stock outstanding 2 move some of its retained earnings to paid-in capital and 3 minimize distributing the corporations cash to its stockholders. Owning stocks that do pay dividends can come with significant benefits to the investor. Here are a few reasons when investors should question the benefits of dividend investing.

Some people want ownership and the ability to influence decisions by using the rights associated with their class of stock. Most dividend stocks pay out quarterly or annually giving investors the assurance of supplemental income to offset planned expenses. Its true that dividends are a great source of return for shareholders especially when combined with dollar-cost averaging.

If you notice many of the high-flying stocks tend to pay little or no dividend eg Amazon and Facebook are high-growth companies that do not pay a dividend. But a company doesnt need to pay out dividends to be worth investing in. What are the reasons for a stock dividend instead of a cash dividend.

Income investors have many reasons to love dividend stocks. Why Do Companies Pay Dividends. Dividend stocks defined by the cash to shareholders as passive income are a popular investment choice.

When you focus on dividend-paying stocks youre naturally cutting out a big chunk of the Stock Market. As a result a company that pays out a. However when a company invests directly in themselves they are only paying taxes on this money once.

Dividend yields are inversely related to stock prices. Like a growth stock which is defined by growing earnings dividend growth refers to a trend of increasing dividends. Dividend Payments Provide Underlying Support To A Companys Stock Price.

In general dividend stocks with 0 yield are a warning sign that a company is facing adverse economic conditions or financial hardships. The following story is meant to help explain non-dividend-paying stocks and. The company may not be doing well.

1 Among investors who focus on dividends there are two primary areas of focus. Although companies do not have to pay dividends those that have already committed to doing so could face investor backlash in the event they fail to pay out profits. When a company pays out a dividend they are taking cash out of their account and paying it to shareholders.

This saves money that would be given to the government and allows it to be put into the growth of the business. In some cases this is literally reaching into the cash register and paying out cash. The stock may not.

Another reason would be to park capital in a place that would grow faster than the rate of inflation. Dividends act as an additional money stream of income but can also substantially enhance long term returns when reinvested. When a company issues dividends the company has to pay taxes on the money and then the shareholders have to pay taxes on money.

Recession war natural disasters and terrorism are just a few macro reasons why stock prices fall. The dividends are typically paid out of cash flow from operating the business. The bottom line is that dividends are just one way companies can put profits to work for shareholders and many stocks that dont pay dividends can.

In this article we will explore why do some companies not pay dividends and the pros and cons of the 5 alternatives to paying a dividend while drawing from examples in our real money portfolio.

Why Do Companies Pay Dividends

Why Do Companies Pay Dividends

How Often Are Dividends Paid On Stocks The Motley Fool

How Often Are Dividends Paid On Stocks The Motley Fool

Why Do Companies Pay Dividends Yadnya Investment Academy

Why Do Companies Pay Dividends Yadnya Investment Academy

Why Do Companies Increase Dividends Quora

Why Do Companies Pay Dividends Cliffcore

Why Do Companies Pay Dividends Cliffcore

The Full List Of Stocks That Pay Dividends In December Free Download

The Full List Of Stocks That Pay Dividends In December Free Download

What Are Dividend Stocks Dividend Com Dividend Com

What Are Dividend Stocks Dividend Com Dividend Com

Why Do Companies Pay Dividends Yadnya Investment Academy

Why Do Companies Pay Dividends Yadnya Investment Academy

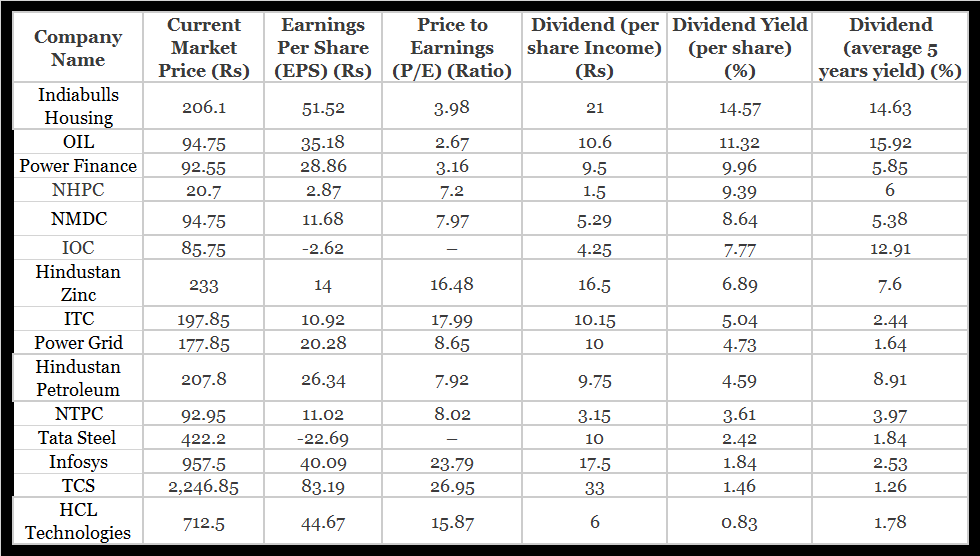

15 Highest Paying Dividend Stocks Of 2020

15 Highest Paying Dividend Stocks Of 2020

3 Reasons Why Some Companies Never Pay Dividends Sure Dividend

3 Reasons Why Some Companies Never Pay Dividends Sure Dividend

What Are Dividends How Do They Work Ally

What Are Dividends How Do They Work Ally

How To Easily Tell If A Company Pays Dividends To Its Investors Quora

What Are Dividends Definitions Insights And How They Work Mintlife Blog

What Are Dividends Definitions Insights And How They Work Mintlife Blog

What Are Dividend Stocks Dividend Com Dividend Com

What Are Dividend Stocks Dividend Com Dividend Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.