145 up from 98 last week. At the start of.

Did Interest Rates Go Up Yesterday Rating Walls

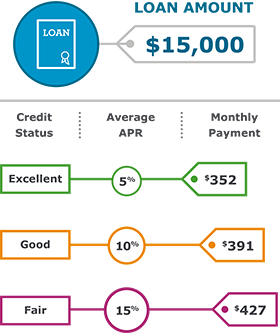

Although the economy may be moderately healthy when rates begin rising rising rates signal the beginning of the end of an economic cycle.

When are interest rates going up. Fed funds futures probabilities of future rate changes by. At the end of 2020 economists forecasted that rates would break the 3 range in 2021 but not rise much higher than 31 to 33. Apr 2021 - up by at least 25 bps.

The Fed stated in June that short-term benchmark interest rates would remain near zero through 2022. CD Interest Rate Forecasts. Dec 2021 - up by at least 25 bps.

We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the two per cent inflation target is sustainably achieved the Bank. Still he expects the 10-year Treasury note to tick up by the end of 2021 from its current rate around 094 percent to 125 percent. Close Posted by 1 minute ago.

Mortgage rates have been on an upward trend in 2021. Rates could go up if the US economy recovers from the pandemic more quickly than expected. The average interest rate.

Is interest rate going higher. January started off with a record-low 30-year mortgage rate of 265. CD rates should stay low in 2021 but they probably wont drop as drastically as they did in 2020.

Rates are now starting to climb and are expected to continue heading higher throughout 2021. Credit union CD specials still exist. Over the past few weeks interest rates have begun to increase faster than expected.

That means that since August of last year when the 10-year yield hit 05 interest rates have more than doubled. Sep 2021 - up by at least 25 bps. Higher interest rates are most certainly in the future but experts arent optimistic they will come anytime soon.

Treasury yields have been rising quickly in the last. Is interest rate going higher. The yield on the 10-year Treasury has risen from 093 at the beginning of December to above 1.

The 10-year Treasury is. 28 down from 61 last week. Any boost to economic growth tends to push up interest rates as the demand for funds grows and inflation possibly rises as well.

Still at the high end of the forecast rates could increase by. But by March 4 rates spiked above 3 for the first time in. In the first phase the CRR will go up to 35 on March 27 2021.

Larger budget deficits will also raise rates as the supply of. Just last week mortgage rates rose to the highest point since August 2020. The Fed stated in June that short-term benchmark interest rates would remain near zero through 2022.

There arent many of them but every now and then one pops up. In the second phase the rate will be increased to 4 on May 22 2021. Interest rates are expected to continue their upward march but for now theyre not expected to get high enough to harpoon the stock market.

But the development of a potential vaccine to prevent the spread of COVID-19 and the possibility. 105 up from 98 last week. But the development of a potential vaccine to prevent the spread of COVID-19 and the possibility of another stimulus package may have savers wondering whether or not theyll still have to wait that long before seeing their money grow again.

When interest rates are at or near historical lows a wise investment move is to prepare for rising interest rates followed by a final move upward for stocks before a decline bear market ensues. We may see small gains in high-yield savings account yields in.

/what-are-interest-rates-and-how-do-they-work-3305855-FINAL2-2f4b8e003d8d475fa79182d2a5cd4aa4.png)