But with the Federal Reserve cutting interest rates high-yield savings rates are harder to find. 2 rânduri Offers provided to customers who originated via a paid Google or Bing advertisement feature rate.

Credit Karma Launches A New Savings Account With 1 90 Apy

Credit Karma Launches A New Savings Account With 1 90 Apy

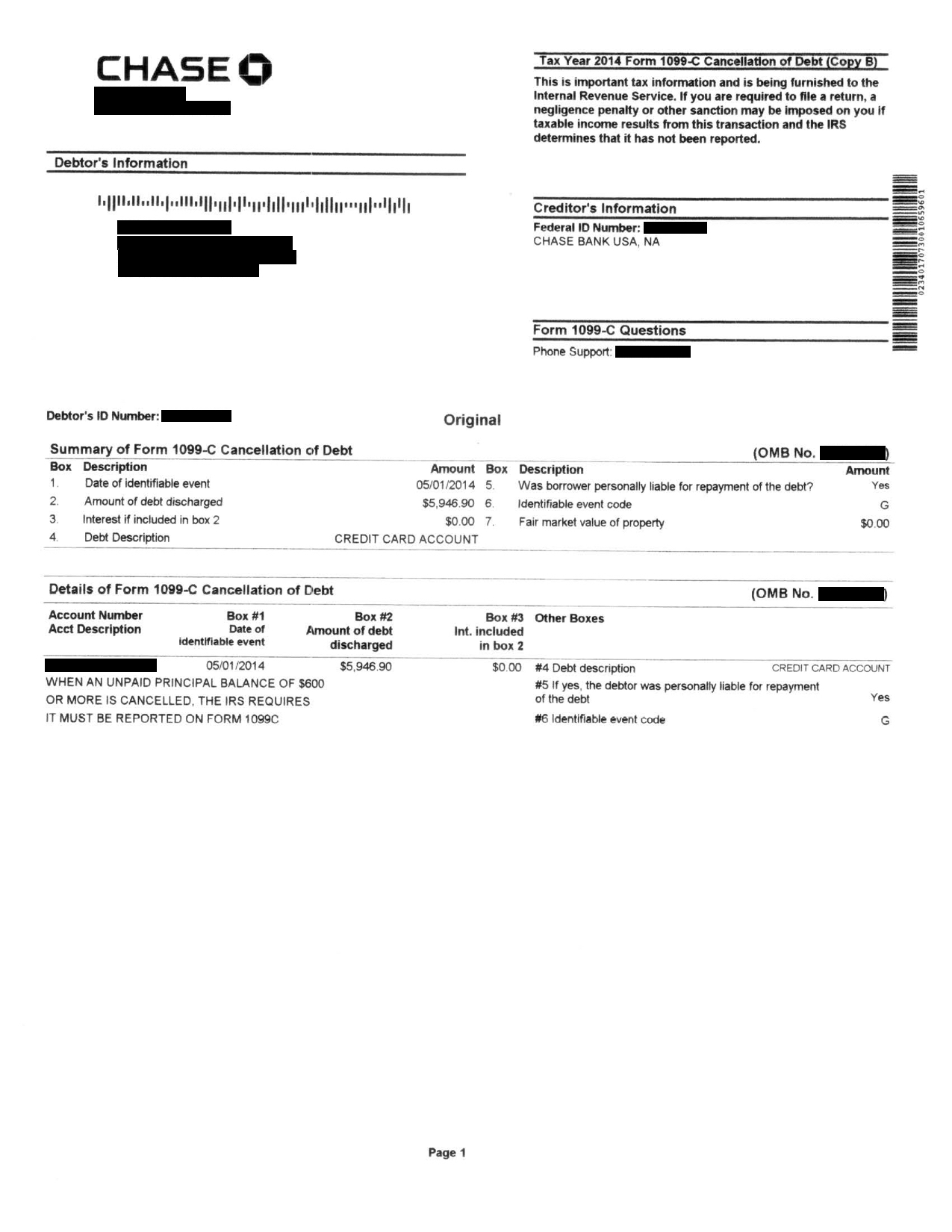

Credit Karma Savings is a high-yield savings account that currently comes with a 030 APY as of February 2021 which is significantly higher than the.

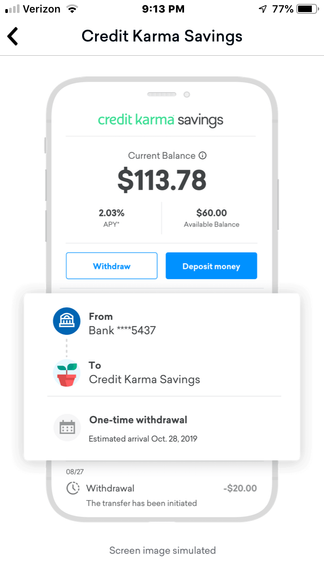

Credit karma savings interest rate. In addition to the current rate from Credit Karma you can also take advantage of a range of great promotions. Credit Karmas new savings option which will not charge any fees and does not require a minimum deposit to open is set to offer a savings rate of 203 APY. Deposit 1 each month for a chance to win a 20000 savings boost.

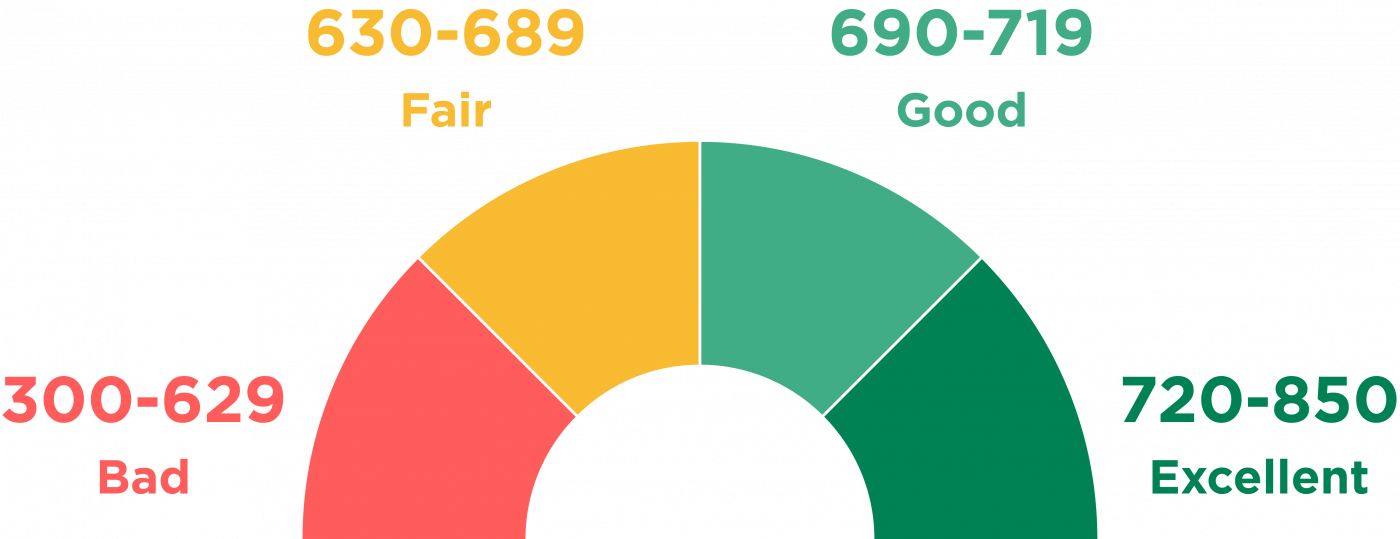

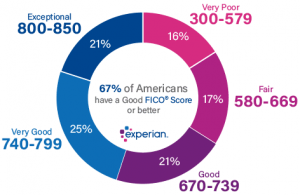

With a national average savings rate of only 009 APY Credit Karmas rate is over 20X the national average. Credit Karma is partnering with a network of banks to hold your deposits and gain Federal Deposit Insurance Corporation FDIC insurance. Credit Karma Savings also wont charge any fees and wont.

Open a Credit Karma Savings account today to take advantage of this interest rate Credit Karma is a consumer technology company that provides credit score information and advice for free. Account is now live and Credit Karma is. Many people allow their savings to sit in accounts that earn very little to no interest.

There wont be any fees or minimum deposit required to open a savings account. Credit Karma savings offers an APY of 040 APY stands for annual percentage yield rates may change. Credit Karma is the latest fintech firm to launch a high-yield savings account.

Funds deposited into your Credit Karma Money Save account are FDIC insured and connections to external accounts are made via the secure API Plaid. Credit Karma Savings Account 030 APY. No check or direct deposits.

The interest rate on a savings account or checking account can change based in part on what the Federal Reserve does. You need to enable. Credit Karma Savings offers a generous 030 APY and the company says it will leverage technology to keep its rates competitive.

Below is all the information you need to earn 040 APY Rate on your funds when you open a Credit Karma High Yield Savings Account. Rate has been reduced to 19 APY from 203. Its service is immensely popular now totaling over 100 million members who love getting free access to their TransUnion and Equifax credit scores and reports.

As of January 2021 Credit Karma Money Save offers 030 APY. Credit Karma is completely free but you must have an existing account to open a Credit Karma Money Save account. But its not the highest percentage out.

What is Credit Karma Money Save interest rate. Credit Karmas savings account has an APY thats a little more than 21-times the national average as reported by the FDIC. Rate has been decreased to 13 APY Update 11319.

If youre looking for a new savings account available nationwide Credit Karma High Yield Savings account is offering you 040 APY on your funds. Credit Karma is offering a 058 APYwhich is significantly better than savings accounts on average across the nation currently 009. While its higher than the national average of 004 youll find higher rates with other savings accounts like Chime or Axos High Yield savings which earns 061 APY.

/article-new/2020/06/apple_card_mac_installments_popup.jpg?lossy)