If you dont plan to use. You can also apply for a tax extension by filling out Form 4868 on paper and sending it via snail mail its less than a page long but just get proof that you mailed it.

How To File An Extension For Taxes Form 4868 H R Block

How To File An Extension For Taxes Form 4868 H R Block

Make a payment of any tax due directly from your checking or savings account.

How to apply for tax extension. If youre not making an estimated tax payment by credit or debit card then you can include a check made out to the US. Exceptional or unforeseen circumstances may affect your ability to lodge by a due date on behalf of your clients and a lodgment deferral may help. Filing your federal tax extension online or through mail doesnt extend the time to pay a balance due.

You can file for an extension with our online program. The following companies partner with the IRS Free File Program so that you can e-file your tax filing extension for free. This way you wont have to file a separate extension form and you will receive a confirmation number for your records.

Everyone Can File an Extension for Free. Learn below if you should even eFile an extension or not. You cannot file your 2020 tax return by May 17 2021 You owe tax for 2020.

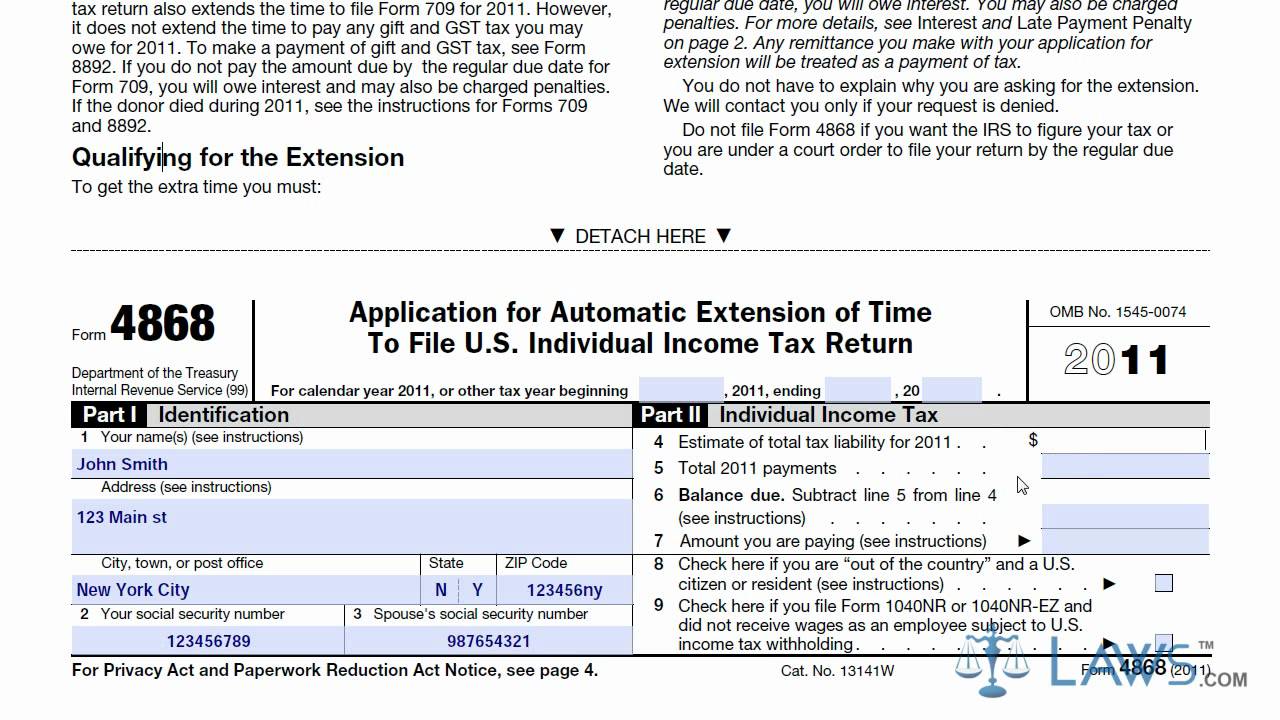

Individual Income Tax Return. Individual Income Tax Return. The application for an automatic extension of time requires minimal information.

Filing Form 4868 gives taxpayers until Oct. If you are affected by the extension enter 912 in one of the code number boxes to the right of the telephone number area. If necessary you may request an extension of time of up to six months beyond the filing deadline to file your return.

All you need to include is your name address and Social Security number. Taxpayers should pay their federal income tax. Taxpayers can request an extension using the Application for Automatic Extension of Time to File US.

Use Payment for Automatic Extension for Individuals FTB 3519 to make a payment by mail if both of the following apply. Easy options for filing an extension. 15 to file their 2021 tax return but does not grant an extension of time to pay taxes due.

If you need even more time to complete your 2020 federal returns you can request an extension to Oct. You can also get an extension by paying all or part of your estimated income tax due and indicate that the payment is for an extension using Direct Pay the Electronic Federal Tax Payment System EFTPS or a credit or debit card. Using TurboTax Easy Extension you can.

If you find yourself in a position where you wont be able to meet the deadline to file your S. If your paid preparer is required to e-file your tax return and is also preparing your extension request the preparer must e-file your extension request. The deadline to e-File a 2020 Tax Extension will be April 15 2021 May 17 2021.

The deadline for mailing the form to the IRS is April 18. File Tax Extension Online You can file a tax extension online using Form 4868 which lets you request an automatic extension of time to file your income tax return. You simply head over to the IRS website and fill out IRS form 4868.

Please be aware that filing an extension gives you time to e-file your federal tax return. E-file your federal tax extension in minutes with TurboTax Easy Extension. While you and any other shareholders are responsible for reporting taxes on the S corp income on.

You can apply to extend your accounts deadline if you cannot send your accounts because of an event thats outside of your control - for example because of. Form 4868 is available on IRSgovforms. 15 by filing Form 4868 through your tax professional tax software or using the Free File link on IRSgov.

Here is How You Can Easily File for a Tax Extension. You can submit a deferral request by completing the current online application and lodging it through Online services for agents OSFA. The online and e-file options provide you with a confirmation that we received your extension request.

If you have a balance due the deadline to pay is still May 17 2021. How to Apply for a Tax Extension for an S Corporation S Corp Tax Extensions. File the extension before the tax return date if the taxpayer has not paid for any tax liability yet or.

More time to file is not more time to pay. You can access this form directly from this link. Fill out a request for an extension using Form 4868 Application for Automatic Extension of Time to File US.

Taxpayers can access Free File to prepare and e-file their return through October 15. Fiscal year filers should contact us to request an extension. If the tax amount relates to a deficiency they paid taxes but lacked funds to pay the whole amount according to the IRS they must send the tax extension form before the due date in the notices.

Print a PDF copy of your e-filed extension. E-file your federal extension. The IRS will automatically process an.

When to apply. The IRS must receive an e-filed extension request by midnight on the day of the filing deadline.