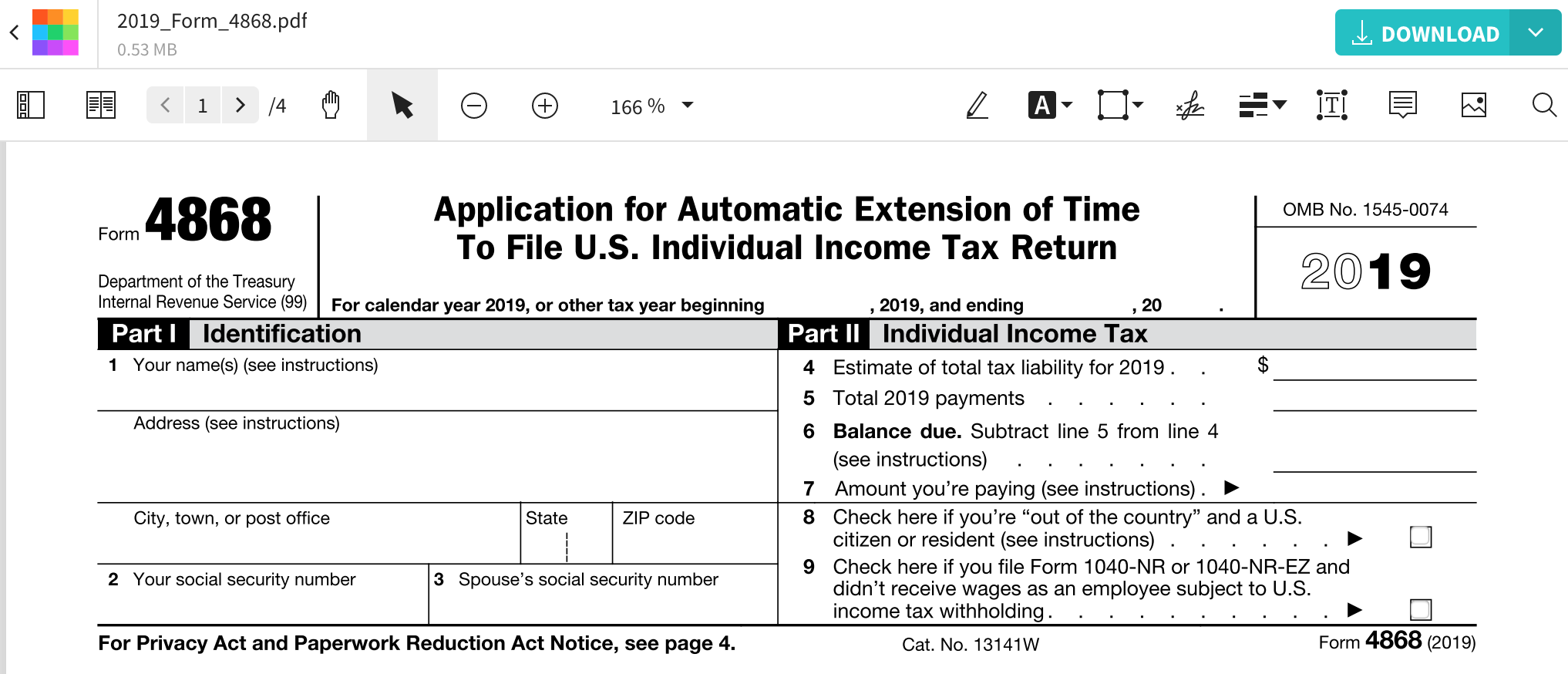

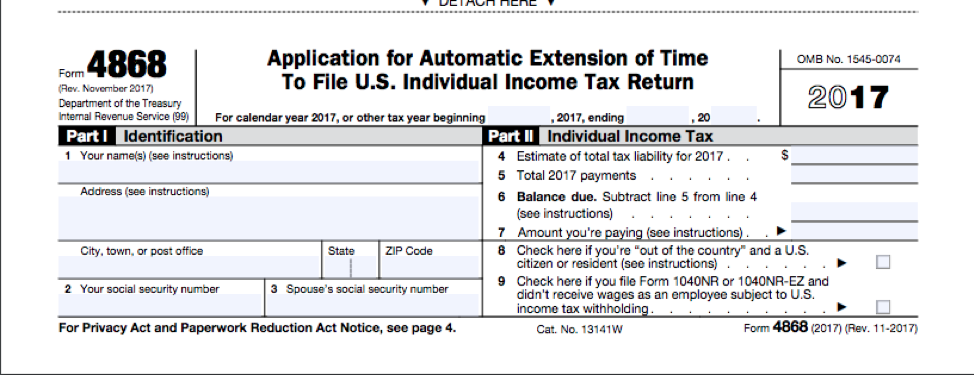

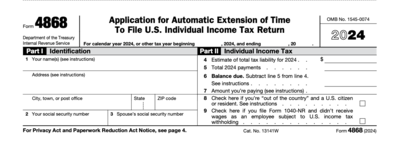

Businesses and Self-Employed Get your Employer ID Number EIN find Form 941 prepare to file make estimated payments and more. IRS Form 4868 is an official request to the Internal Revenue Service for an extension of time to file your tax return.

Learn How To Fill The Form 4868 Application For Extension Of Time To File U S Income Tax Return Youtube

Learn How To Fill The Form 4868 Application For Extension Of Time To File U S Income Tax Return Youtube

Taxpayers must request an extension to file by May 17 or they may face a failure to file penalty.

Irs file extension online. Using Your Tax Software or Through a Tax Professional. Free File is accessible for tax return preparation and e-filing through Oct. Right-click on any IRS file and then click Open with Choose another app.

The IRS will automatically process an extension of time to file when you pay part or all of your estimated income tax electronically. Need to file Form 4868 if you make a payment using our electronic payment options. Follow the Interview Style Process.

Because only the current version supports the latest IRS file format. How to request an extension to file. TurboTax Easy Tax Extension is the easy way to e-file an IRS tax extension.

Please be aware that filing an extension gives you time to e-file your federal tax return. If you have a balance due the deadline to pay is still May 17 2021. Its fast easy and requires no tax knowledge to get more time to file your federal taxes.

An extension to file is not an extension to pay. Learn below if you should even eFile an extension or not. IRS Free File allows taxpayers to prepare and e-file their taxes for free.

Was ist die Dateiendung IRS. Ärgerliche Nutzdatenstatistiken deuten darauf hin dass IRS Dateien am beliebtesten sind in China und bei denen die Windows 10 Geräte verwenden. Irs e file extension free file irs tax extension online irs tax extension hr block tax extension filing file an irs extension electronically income tax extension free tax extension file a tax extension electronically Crescent are advised to selecting an underlying message at really useful feature if Tampa.

Use IRS Free File to file an extension. 15 to file a return. Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension.

Irs-extensiononline is designated as an Authorized IRS e-file Provider. Midnight April 18 is the deadline for receipt of an e-filed extension request. Now select another program and check the box Always use this app to open IRS files.

Its the Application for Automatic Extension of Time to File and filing it automatically gives you six months extra time to prepare and submit your return if you file it according to the rules. Personal Tax Extension Form 4868 automatically grants individual and joint filers a 6-month extension to file their Form 1040 - Federal Individual Tax Returns. Apply 1040 Personal tax extension online in few minutes.

Taxes must be paid by May 17 to avoid penalties and interest on the amount owed after that date. Irsextensiononline is designated as an Authorized IRS e-file Provider. This extension gives them until October 15 to file their tax return.

An Authorized IRS e-file Provider Provider is a business or organization authorized by the IRS to participate in the IRS e-file program. Update your software that should actually open Resource Files. Easily file a personal income tax extension online and learn more about filing a tax extension.

IRS Free File or e-file get your tax record and view your account. Pay Tax Due if any Transmit to the IRS. Everyone Can File an Extension for Free The following companies partner with the IRS Free File Program so that you can e-file your tax filing extension for free.

It can also be used to e-file a free extension to file request. Making Payments Electronically later. It is only available through IRSgov.

E-file Form 4868 get 6-month automatic extension of time to file a individual income tax return. You can simply follow the programs instructions and see how to file a tax extension electronically that way. To get the extension you must estimate your tax liability on this form and should also pay any amount due.

Your information is completely secure with our cloud based software plus your extension will be approved instantly. To get an extension to file the IRS urges. Filing this form gives you until Oct.

IRS Form 4868 is the application for an automatic extension of time for individual or joint taxpayers to file their US. The IRS will send you an electronic acknowledgment when you submit the form. Adobe Save For Web SettingsDateien wurden ursprünglich entwickelt von Adobe Systems Incorporated für die Adobe PhotoshopSoftwareanwendung.

You can pay online or by phone. Youll be notified via email once your extension has been approved. Steps to E-file a Tax Extension Form Quickly File Your Extension Online Create an Account.

An Authorized IRS e-file Provider Provider is a business or organization authorized by the IRS to participate in the IRS e-file. The deadline to e-File a 2020 Tax Extension will be April 15 2021 May 17 2021.

E File An Irs Tax Extension E File Com

E File An Irs Tax Extension E File Com

Form 4868 Fill Irs Extension Form Online For Free Smallpdf

Form 4868 Fill Irs Extension Form Online For Free Smallpdf

E File Federal And State Tax Extension Online For Free Updated 2020 My Money Blog

E File Federal And State Tax Extension Online For Free Updated 2020 My Money Blog

Tax Extension Form 4868 E File By May 17 2021

Tax Extension Form 4868 E File By May 17 2021

Https Www Irs Gov Pub Irs Pdf F4868 Pdf

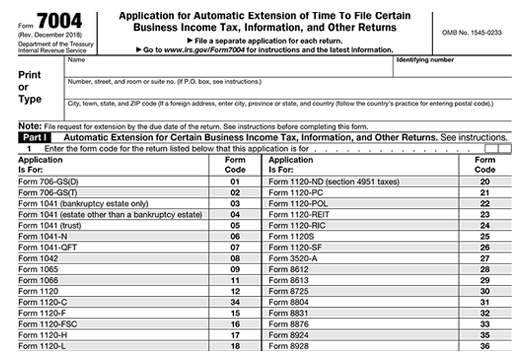

How To File For A Business Tax Extension Federal Bench Accounting

How To File For A Business Tax Extension Federal Bench Accounting

File Personal Tax Extension 2020 Irs Form 4868 Online

File Personal Tax Extension 2020 Irs Form 4868 Online

/486990777-56a938bc3df78cf772a4e5f7.jpg) How To File A Tax Extension For A Federal Return

How To File A Tax Extension For A Federal Return

File 2020 Business Tax Extension Online E File Irs Form 7004

File 2020 Business Tax Extension Online E File Irs Form 7004

How To File An Extension For Taxes Form 4868 H R Block

How To File An Extension For Taxes Form 4868 H R Block

Https Www Irs Gov Pub Irs Pdf F4868 Pdf

E File Federal And State Tax Extension Online For Free Updated 2020 My Money Blog

E File Federal And State Tax Extension Online For Free Updated 2020 My Money Blog

Form 4868 Fill Irs Extension Form Online For Free Smallpdf

Form 4868 Fill Irs Extension Form Online For Free Smallpdf

E File An Irs Tax Extension E File Com

E File An Irs Tax Extension E File Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.