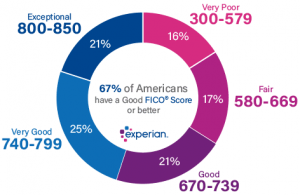

Other services may also offer scores for purchase. Credit scores range from 300 to 850 and are often crucial to the homebuying process.

Can I Buy A House With A 700 Credit Score Experian

Can I Buy A House With A 700 Credit Score Experian

Annual Credit Report Request Service P.

Purchase credit score. Having scores from all 3 bureaus is also important if youre preparing for a mortgage. Free Credit Score. Your utilization rate is calculated by adding up the total of all your balances on credit cards and dividing it by the total of all your credit card limits.

Crédit à la Consommation au meilleur taux. Your FICO score determines which type of mortgage loan youre eligible for or whether you qualify at all. However the minimum credit score requirements vary based on.

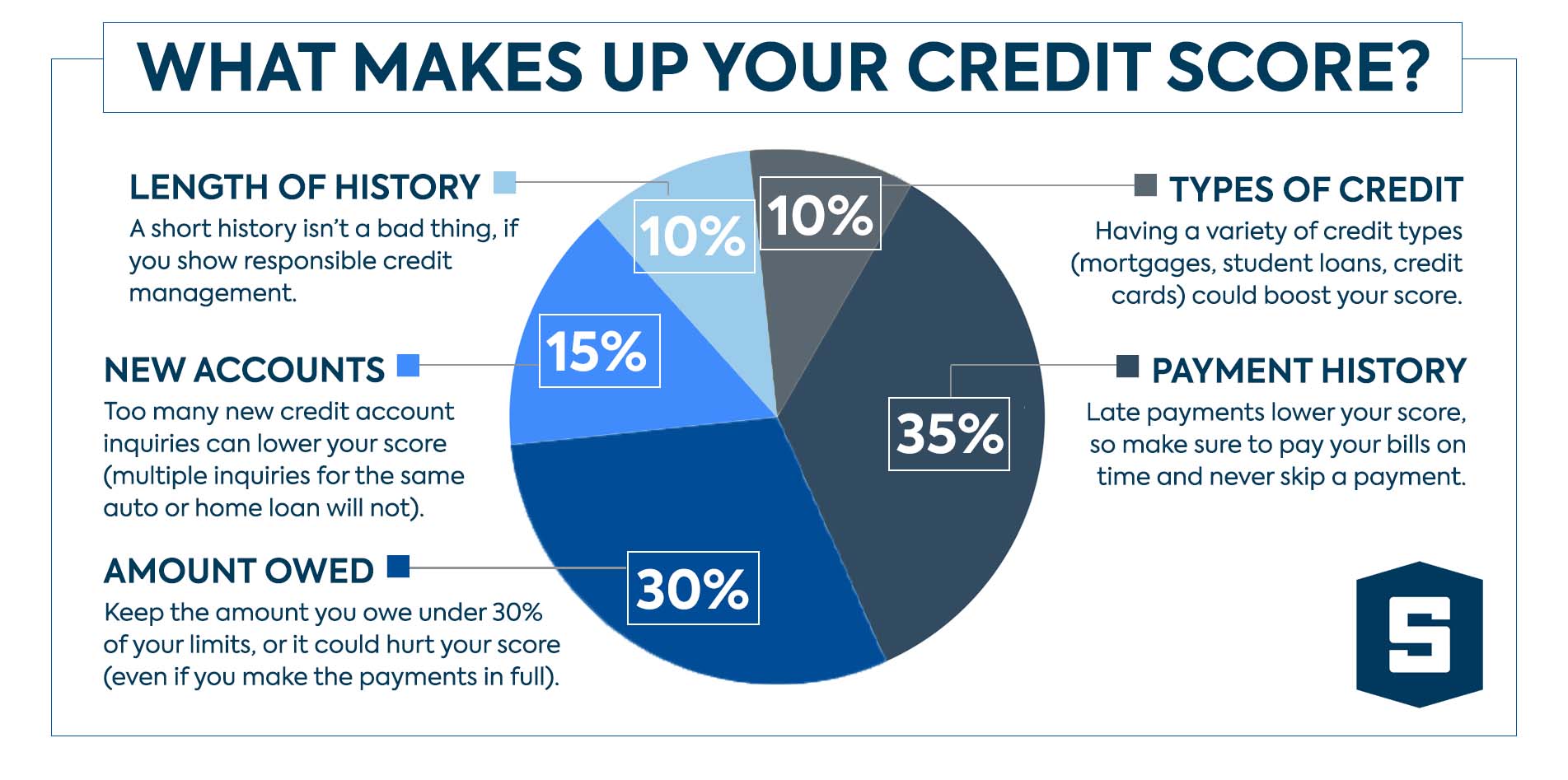

You need your score from all 3 bureaus to identify. Annonce Comparez les Meilleurs Credits Conso. The biggest factor that affects your score is p ayment history.

One-time cost of 3999 Check all 3 now Credit score calculated based on FICO Score 8 model. If most of your accounts are maxed ou t or reaching its limits your credit will take a hit. FHA home loan These are government loans insured by the Federal Housing.

Get the score lenders use Get your FICO Score90 of top lenders use FICO Scores. The second largest factor is the amount that you owe overall across all your accounts. Prospective home buyers should aim to have credit scores of 760 or greater to qualify for the best interest rates on mortgages.

Crédit à la Consommation au meilleur taux. Your lender or insurer may use a different FICO Score. Out of the 3 credit scores from each bureau mortgage lenders will use whats called the middle score.

Use a credit score service or free credit scoring site. This is the second most-important factor in your credit score making up 30 behind only payment history at 35. Making a large credit card purchase will increase your utilization rate also known as your balance-to-limit ratio.

Programs for borrowers buying a house with a 600 credit score include. This all relates to the amounts owed on your credit accounts frequently called credit utilization which looks at how much of your available credit youre using at a given time. Simply log in every month to see your latest VantageScore credit score Equifax credit report.

See if your VantageScore credit score 1 is strong. The lower your utilization rate the better for your credit scores. You can purchase your individual and 3-in-1 credit scores from each of the credit bureaus.

5 Ways to Get Your Credit Score 1. Check your credit score. Simulation 100 Gratuite et Sans Engagement.

This score is based on your Experian Equifax and Transunion. By law each of the three major credit reporting. Both your credit reports and FICO Scores can vary from bureau to bureau and your lender may pull your report and FICO Scores from any or all 3 of them.

You can buy a score directly from the credit reporting companies. Some sites provide a free credit score to users. Purchase credit scores directly from one of the three nationwide credit bureaus or other provider such as FICO.

Get the right score for your credit goal including your FICO Scores used for mortgages auto loans and credit cards. Any of the Credit Bureaus. If you decide to purchase a credit score you are not required to purchase credit protection identity theft monitoring or other services that may be offered at the same time.

Its also the one that could be most affected when you. If you have a poor payment history that could drastically decrease your credit score. Simulation Gratuite et rapide en ligne.

Remember that your balance relative to your credit limit is included in your credit score. Simulation Gratuite et rapide en ligne. Simulation 100 Gratuite et Sans Engagement.

Others may provide credit scores to credit monitoring customers paying a. Create a myEquifax account - its fast and easy. It is Ideal to keep your credit utilization around a 30 threshold o r lower.

Your last credit card payment amount is listed on your credit report but its not factored into your credit score. Although they may look the same other credit scores can. Larger payments reduce your balance faster and can help boost your credit score.

Even so your payment amount can indirectly influence your credit score. Impact of a Large Credit Card Purchase on Credit Utilization. The general rule of thumb is that you should stay below a 30 percent utilization rate.

Box 105281 Atlanta GA 30348-5281. Annonce Comparez les Meilleurs Credits Conso.