However theres no secret to raising your score and it cant happen overnight. But significant credit-score improvement is generally measured in months and years.

What Makes A Good Credit Score And How To Improve Yours

What Makes A Good Credit Score And How To Improve Yours

Once the error is removed from your credit report it will factor into your credit score right away.

How long to get credit score up. Your payment history is one of the most important factors in determining your credit scores and having a long history of on-time payments can help you achieve excellent credit scores. In general credit history is built up slowly over time as you increase the number of on-time payments you make. And exactly how long it will take depends on three factors.

Over a year your score will rise quickly. To do this youll need to make sure you dont miss loan or credit card payments by more than 29 dayspayments that are at least 30 days late can be reported to the credit bureaus and hurt your credit scores. With that being said credit improvement can be big or small.

Such positive credit behaviors can start to improve your score as soon as a few. Your credit score derived from your credit history and necessary for credit card or mortgage applications used to be difficult to access. Credit histories have long memories and things like missed payments will stay on your record for seven years while bankruptcies will be on there for up to 10.

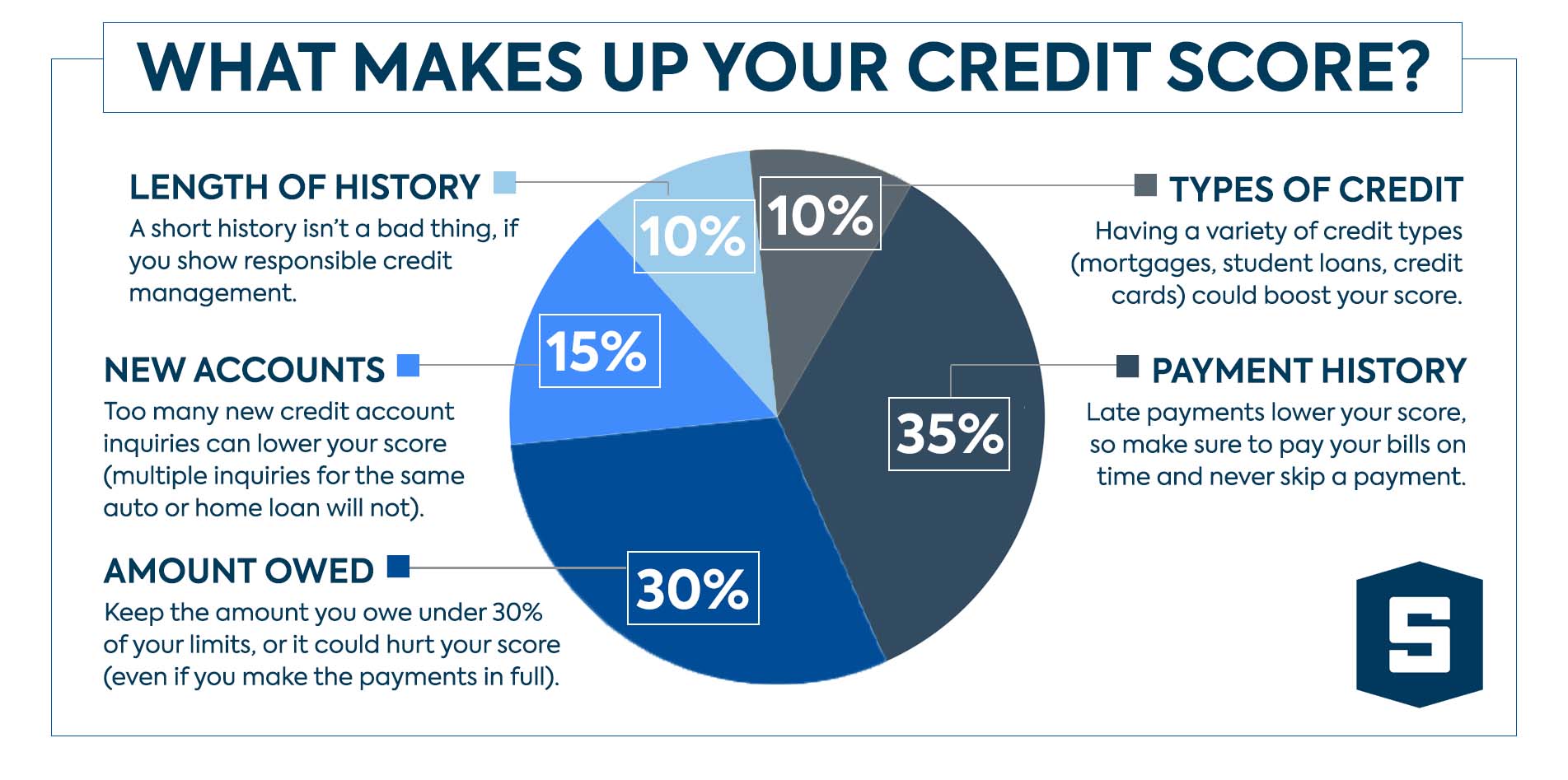

Its certainly possible to improve your credit score by a few points in a few weeks. Your utilization rate is calculated by adding up the total of all your credit card balances and dividing them by the total of all your credit card limits. Just make a commitment to reduce your debts and to pay your credit cards and other bills on time.

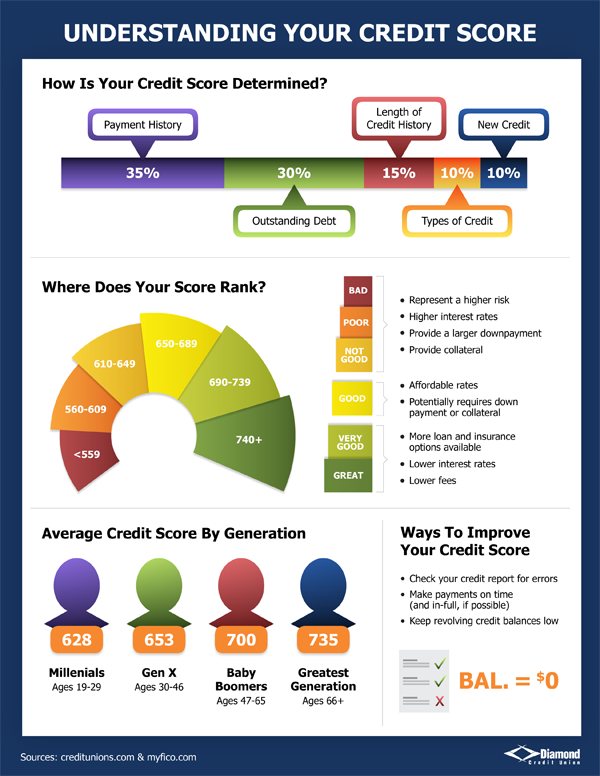

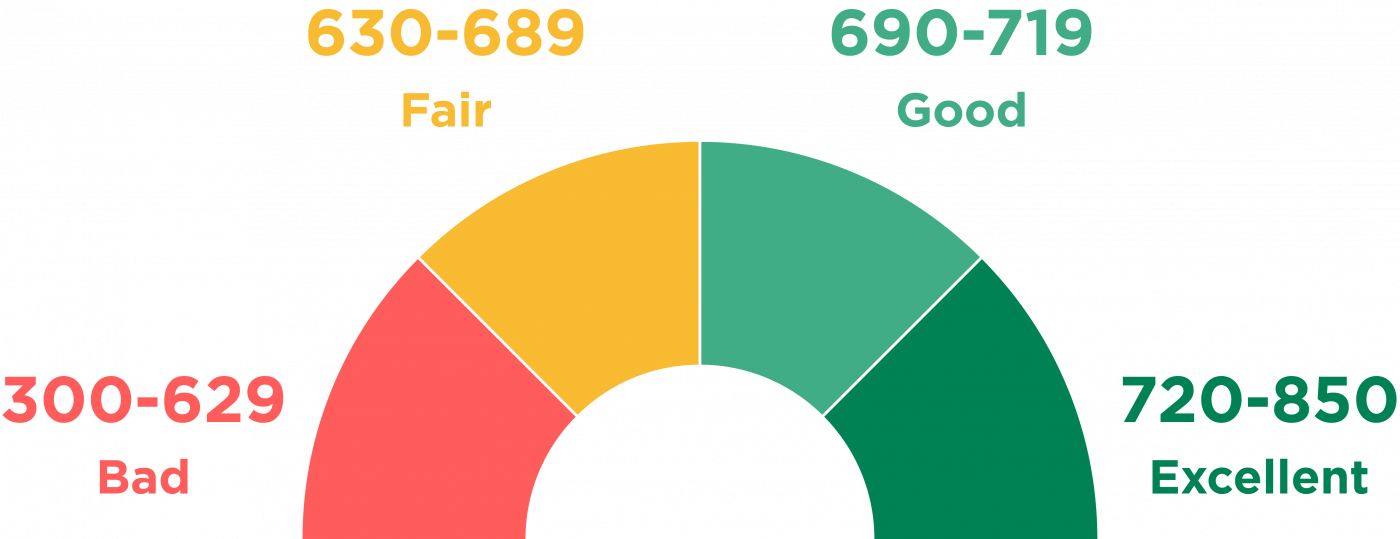

How Long Does It Take to Improve Your Credit Score by 200 Points. You can always make improvements in your credit scores but theres no guaranteed timeline for gaining a set number of points. Scores over 800 are considered excellent.

No credit card needed. 1 FICO credit scores range from 300-850 and a score of over 700 is considered a good credit score. You make monthly payments into an interest-bearing certificate of deposit CD for up to 24 months.

If youre looking for full credit recovery youre looking at a much lengthier process. How to Monitor Your Credit Score. 7 Zeilen The length of time it takes to raise your credit score depends on a combination of multiple.

In the past you might have held off on trying to check your credit score because you didnt want to pay upwards of 15 for the service. How Long Before a Credit Score Can Be Calculated. The longer the bill goes unpaid the more likely it is to affect your credit score.

Also as noted earlier paying off a large balance at once will pop your score up by 20 points or even more in some cases. Keep a close eye on your credit score to help you spot issues. If youve just opened your first credit account you probably wont have a credit score immediately.

Your payment history and utilization rate typically account for 60 to 70 of a credit score according to Experian. Credit repair companies sometimes promise almost instant results saying that they will do the hard work. Credit builder loans can offer a small credit score boost as you lend money to yourself.

Raising your credit score by 200 points will take some time and effort but the sooner you start practicing healthy credit habits the sooner youll see positive incremental changes to your score. Companies are making it easier than ever to obtain a free credit score and you can get one in a. Most credit scoring systems require approximately six months of history in order to calculate a score.

Accounts usually need to have a minimum of three months and perhaps as much as six months of activity before they can be used to calculate a credit score. The lower your utilization rate the better so reducing or paying off any balances you are carrying on your credit cards will positively impact your credit report and scores. Here are 6 steps to help you improve your credit score TODAYSign up for Credit Seasame FREE.

Now that doesnt mean that you cant improve your credit in the short-term because you can. It will take about six months of credit activity to establish enough history for a FICO credit score which is used in 90 of lending decisions. Its suggested that you request a credit line increase about once every 6-12 months.

The dispute process can take 30 to 45 days while the credit bureau investigates then updates your credit report. You can actually increase your credit score substantially in a year. Dont expect a spectacular number right off the bat.

Why Won T My Credit Score Go Up Refresh Financial

Why Won T My Credit Score Go Up Refresh Financial

Know Your Credit Score Infographic Diamond Cu

Know Your Credit Score Infographic Diamond Cu

8 Ways To Build Credit Fast Nerdwallet

8 Ways To Build Credit Fast Nerdwallet

How To Raise Your Credit Score 200 Points In 5 Steps Student Loan Hero

How To Raise Your Credit Score 200 Points In 5 Steps Student Loan Hero

How Your Credit Score Is Calculated Wells Fargo

How Your Credit Score Is Calculated Wells Fargo

/things-that-boost-credit-score-8ee7c4392e764cceb0deae74b741e000.gif) How To Boost Your Credit Score

How To Boost Your Credit Score

Infographic How To Raise Your Credit Score Fast Primerates

Infographic How To Raise Your Credit Score Fast Primerates

How To Improve Your Credit Score Fast Experian

How To Improve Your Credit Score Fast Experian

6 Ways To Keep Your Credit Score High

6 Ways To Keep Your Credit Score High

How To Improve Your Credit Score Tips For Fico Repair

How To Improve Your Credit Score Tips For Fico Repair

How To Improve Your Credit Score By 100 Points In 30 Days

How To Improve Your Credit Score By 100 Points In 30 Days

What S The Best Way To Increase Someone S Credit Score Fast Quora

What S The Best Way To Increase Someone S Credit Score Fast Quora

![]() How To Raise Your Bad Credit Score Above 700 Mybanktracker

How To Raise Your Bad Credit Score Above 700 Mybanktracker

5 Sneaky Ways To Improve Your Credit Score Clark Howard

5 Sneaky Ways To Improve Your Credit Score Clark Howard

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.