The average income tax rate for all Americans was 146 in 2017 according to the Tax Foundations method of calculation. In 2018 Americans filed 1538 million individual tax returns for some 118 trillion in income.

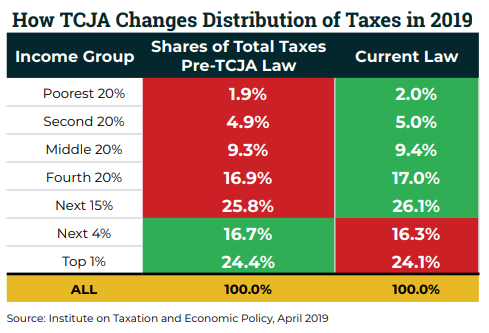

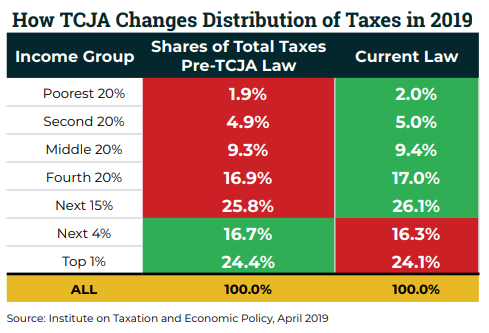

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

CBDT clarified that tweets are in response to.

How many americans pay income tax. Forty-seven percent of Americans dont pay taxes. The average single American contributed 298 of their earnings to three taxes in 2019income taxes Medicare and Social Security. Almost 6 in 10 will be paying income tax within three years and just one-in-eight are non-payers for a decade or more.

Among the 153 million Americans who filed tax returns in 2018 the average federal income tax payment was 15322 according to the most recent IRS data based on 2018 federal income taxes. By the way Fullerton and Rao found a similar story when it comes to. The income tax department on Thursday said that only 146 crore people pay tax on their income in the country.

Published by Erin Duffin Apr 23 2020. This statistic shows the percentage of households in the United States that paid no income tax in 2019 by income level. As a result of tax reform 9 out of 10 taxpayers got a tax cut which most Americans received through lower employer withholding.

A five-figure tax bill isnt unusual The most recent IRS data revealed that Americans who filed taxable returns paid an average income tax payment of 15322 in 2018. As fewer Americans pay income taxes the remaining taxpayers shoulder a greater share of the burden. As a result the income tax burden has grown more progressive over time.

The effective tax rate was 123. Even if most people got a tax cut some people are concerned that. President Biden on Wednesday proposed tax increases for high-income individuals including increases to the top income tax rate and capital gains tax rate as a way to pay.

Household paid 8367 in federal income taxes in. In 2019 about 466 percent of US. From 1986 to 2016 for example the top 1 percents share of income taxes rose from 258 percent to 373 percent while the bottom 90 percents share fell from 453 percent to 305 percent.

The most pernicious misconception about people who dont pay federal income taxes is that they dont pay any taxes. According to the Bureau of Labor Statistics Consumer Expenditure Survey the average US. To pay for his families plan he would hike the tax rate on capital gains to 396 percent and raise the rate for the top one 1 percent of income earners to 386 percent.