Have a balance owing. You will get a refund if you paid more taxes than needed.

E File 1040x Rightway Tax Solutions

E File 1040x Rightway Tax Solutions

One of the first things to do is gather all of the forms youll need to file your tax return.

How to file taxes electronically. You still have the option to submit a paper version of the Form 1040-X and should follow. As to how you can file taxes electronically there are a couple of ways. The happy medium between doing everything yourself and using a tax software is to.

Youll need to have an adjusted gross income AGI of 66000 or less. For businesses and other taxpayer audiences see the links to the left. Four electronic filing options for individual taxpayers are listed below.

If you are charged a fee stop and contact the vendor directly Choose TaxAct. Pay taxes you owed options if you cannot pay or arrange to pay over time. If you were to pay for it filing taxes electronically could run you about 50 to 100 depending on your tax return.

Then put any important tax information you receive in that folder until youre ready to file your tax returns. Free e-file help If you have limited income andor are over the age of 60 you may get free help e-filing your tax return through the Voluntary Income Tax Assistance VITA and Tax Counseling for the Elderly TCE program. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

If youre wondering how to file taxes online for free IRS Free File gives you that option. You must sign IRS Form 8879 the IRS e-file Signature Authorization before a certified public accountant or anyone else who prepared your taxes can submit your return on your behalf. File your tax return online or mail us your completed tax return.

Your federal AGI was 72000 or less and you served as Active Duty Military including Reservists and National Guard. After you file your tax return. Electronic Filing Options The CRA offers two ways to file tax returns electronically.

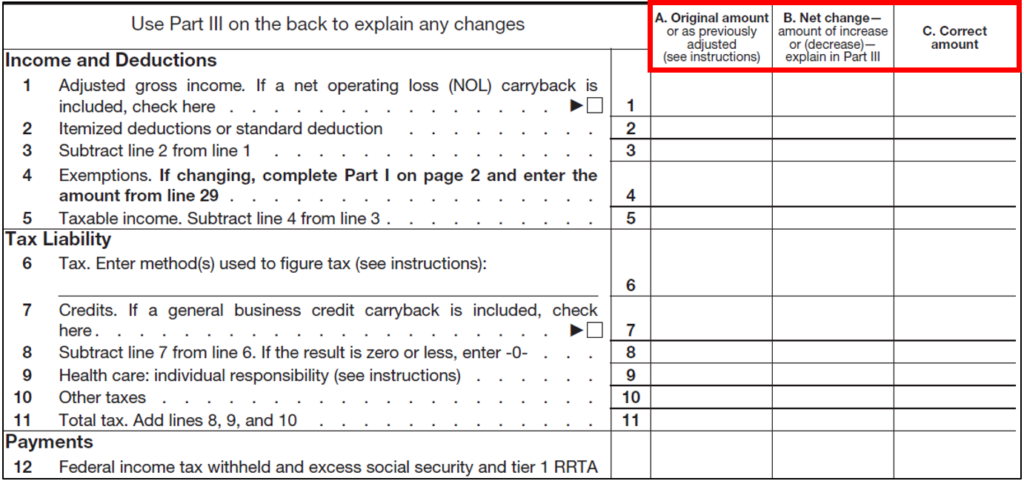

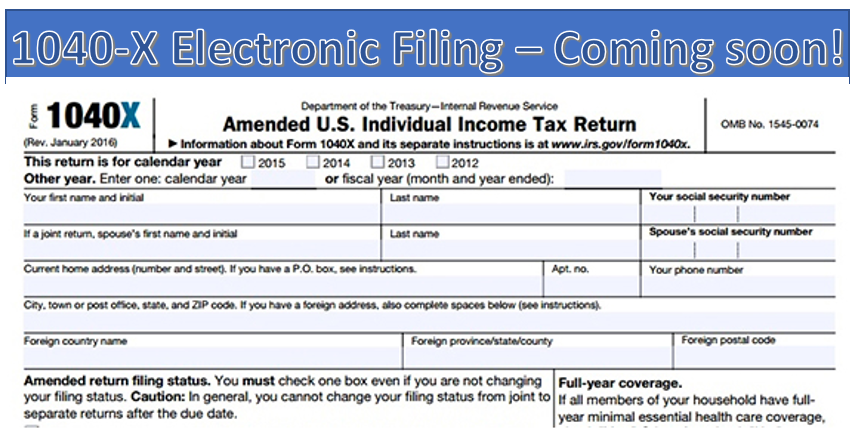

If you meet an e-file providers requirements to file taxes for free you wont need to pay for filing taxes. Only tax year 2019 Forms 1040 and 1040-SR returns can be amended electronically. You can e-file your taxes free with the IRS at the filing portal link at IRS Free File.

Individual Income Tax Return electronically using available tax software products. Find an authorized e-file provider near you. Many people think filing online is expensive because it requires certified tax preparation software.

You must access the Tax Act Free File website from this page otherwise you may be charged a fee. The IRS requires that nearly all tax preparers file their clients returns electronically so your CPA should be familiar with the form. Use IRS Free File or Fillable Forms Use IRS Free File if your adjusted gross income is 72000 or less.

Filing an income tax return electronically is simple by visiting the IRS Web site fin. If you prepare returns only for yourself Netfile supports direct transactions between you and the CRA. How to E-file Income Tax Returns.

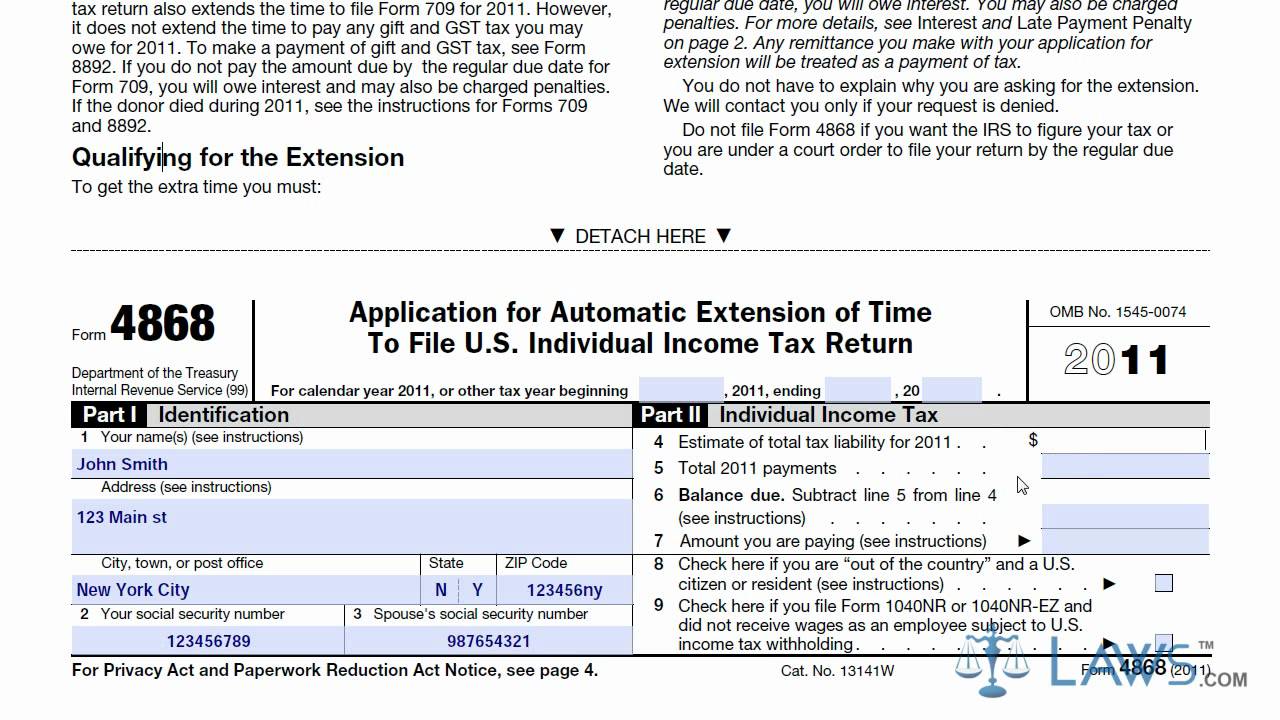

Make a payment or wait for your refund. Consider starting a folder for your tax return at the beginning of a tax year. You can now submit the Form 1040-X Amended US.

You can file your taxes online for free. File Taxes Electronically 2021 - If you are looking for an efficient way to prepare your taxes then try our convenient online service. If you prepare tax returns for others or you have your personal.

The only way to avoid late filing penalties is to e-File or file a Tax Return or Extension by Tax Day - May 17 2021 for Tax Year 2020 - and in case of a Tax Extension e-File the Tax Return by October 15 2021. If thats the case the IRS will. Electronically File Taxes Online - If you are looking for an efficient way to prepare your taxes then try our convenient online service.

Printing or electronically filing your return reflects your satisfaction with TurboTax Online at which time you will be required to pay or register for the product. Part of the series. The Canada Revenue Agency CRA has a list of CRA-certified commercial tax preparation software packages and web applications to.

If you do not file or e-File andor pay your taxes on time you may be subject to IRS penalties. Please see IR-2020-107 and IR-2020-182 for additional information.