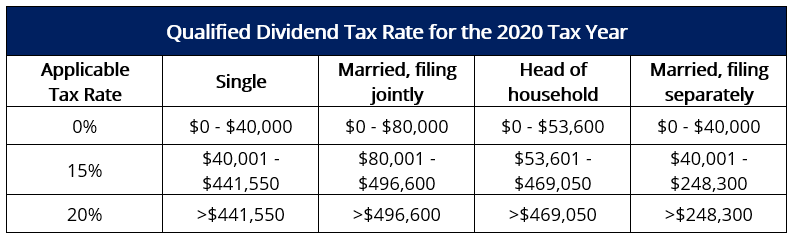

Similarly for the 2020 tax year the capital gains rate is the same as 2018 but the brackets changed slightly due to inflation. The tax treatment of qualified dividends has changed somewhat since 2017 when they were taxed at rates of 0 15 or 20 depending on the taxpayers ordinary income tax bracket.

Capital Gains Rates Before And After The New Tax Law Kwc Virginia Accounting Firm

Capital Gains Rates Before And After The New Tax Law Kwc Virginia Accounting Firm

For the top 37 tax bracket qualified dividends are taxed at 20.

Ordinary dividend tax rate. Shareholder does not reside in the countries listed or if the shareholder does not provide the IRS form required to show residency. Your Dividends are taxed at the long-term capital gains tax rate on Qualified Dividends that is. Ordinary dividends are taxes at your ordinary income rate however so keep that in mind.

The dividend tax rate you will pay on ordinary dividends is 22. 10 to 15 your tax on qualified dividends is zero. The dividend tax rate you will pay on ordinary dividends is 22.

That means that the dividend tax rate on ordinary dividends is 22 percent. That rate is capped at 20 on the maximum level and 0 obviously at the minimum level. Property dividend payments by domestic corporation to citizens and resident aliens.

Under current law qualified dividends are taxed at a 20 15 or 0 rate depending on your tax bracket. More than 15 to less than 37 qualified dividends are taxed at 15. The tax rate on.

Qualified dividends are dividends that meet the requirements to be taxed as capital gains. The withholding rate is 30 other than for a governmental entity if the non-US. Tax band Tax rate on dividends over the allowance.

Witholding Tax Rates on Ordinary REIT Dividends to Non-US. The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. Property dividend payment by domestic corporation to Non-Resident Foreign Corporations.

But an earlier Biden plan for financing health-care initiatives indicates the new president will tax long-term capital gains and qualified dividends at the new top ordinary income tax rate of 396. Total of dividend reported the total of dividend amounts reported to us as detailed in the source of income section of the schedule. Investors As of Jan.

Cash dividend payments by domestic corporation to citizens and resident aliens. Companies that pay these earnings to stockholders on record report all. Ordinary dividends are taxed as ordinary income.

What is the dividend tax rate. The federal income tax brackets range from 10 to 37 for the 2018 tax year after being 10 to 396 in 2017. When you to report qualified dividends you will be paying tax at a slightly different rate.

The tax rates for ordinary dividends typically those that are paid out from most common or preferred stocks are the same as standard federal income tax rates or 10 to 37 for the tax year 2020. Then the Tax Cuts and Jobs Act came along and changed things up effective January 2018. The tax rates in the.

Qualified dividends on the other hand are taxed at the capital gains rates which are lower. 7 rânduri 2020 Ordinary Dividend Tax Rate For Single Taxpayers For Married Couples Filing Jointly For Heads. The tax rate you pay on ordinary dividend earnings is at the same level as taxes for regular federal income or wages.

Dividend income shown in your tax return the dividend income you declared in your tax return. Cash dividend payment by domestic corporation to Non-Resident Foreign Corporations. These will be taxed at the same rate as capital gains which tend to be noticeably lower.