However the rules are complex and the rate caps dont always apply to car loans. If you put 12 down on a home that costs 200000 youll need 24000 to close on the home.

How To Get A Loan From A Bank Wells Fargo

How To Get A Loan From A Bank Wells Fargo

This could be anywhere from 5 to 24 percent depending on where you live.

/what-are-interest-rates-and-how-do-they-work-3305855-FINAL2-2f4b8e003d8d475fa79182d2a5cd4aa4.png)

Whats a high interest rate on a loan. The Fico credit score which is one of the most popular metrics used by lenders ranges from 300 to 850 for individual borrowers. The average business loan interest rate for a small business loan in 2020 ranges from as low as 2 or 3 to as high as 100 or more. Only a small portion actually goes towards decreasing your debt.

If you have a credit score of 750 36 interest rate would be a considered a higher interest rate. High interest rates are how lenders mitigate the risk of making loans to people with bad credit. If that house costs 250000 youll need 30000.

The monthly payment is almost equal. The Federal Deposit Insurance Corporation FDIC reports that the type of accounts that usually earn the highest interest rates are money market accounts savings accounts and. How Do Auto Loans Work.

Today hard money loan rates range from 7 ½ to 15 percent. One lender offers a lower interest rate but charges a higher fee. But interest rates can vary widely from around 6 up to 36 whereas the range is typically lower with a bank personal loan.

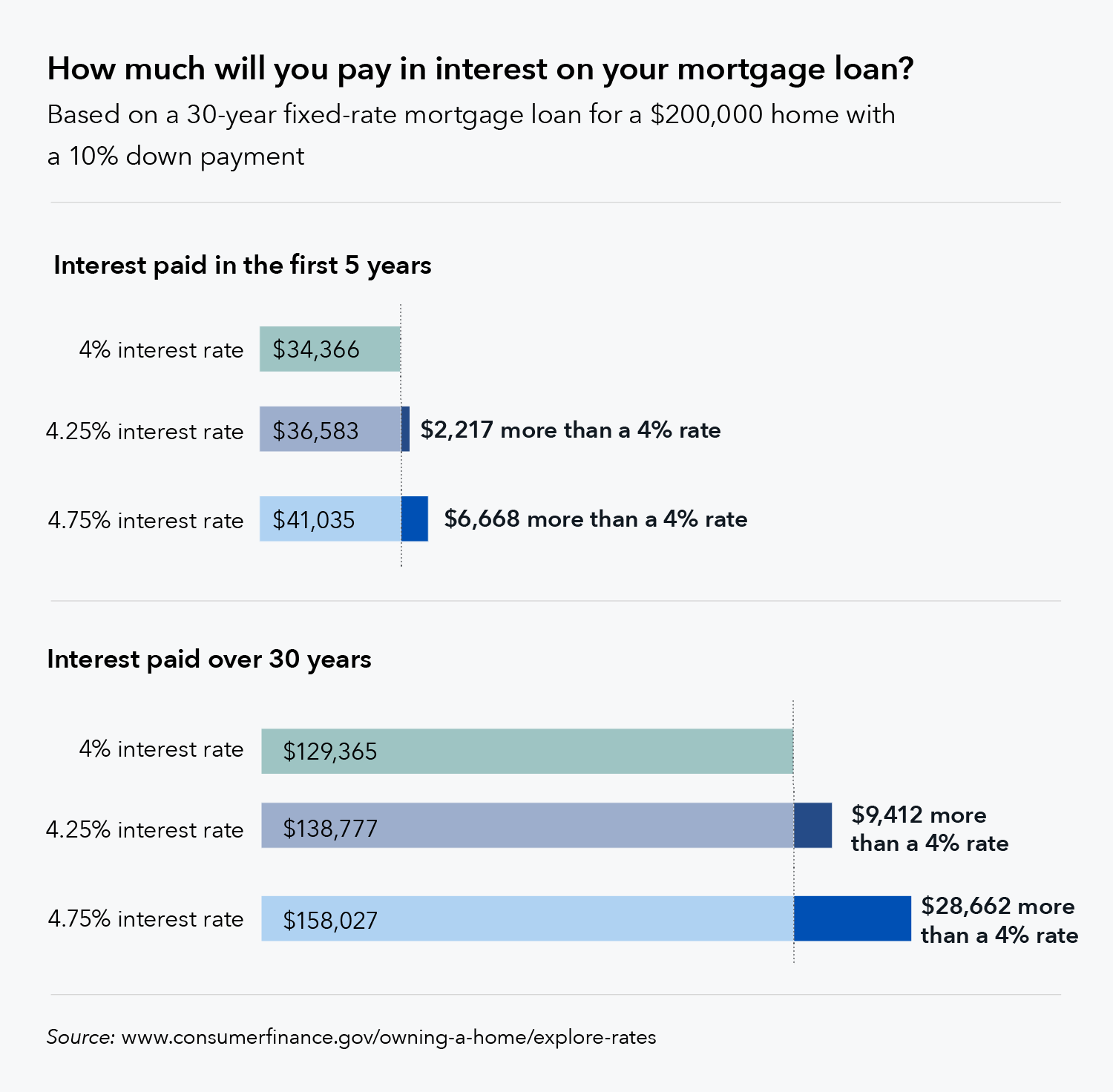

They also often have points or fees that offset the administrative costs. This means that if you make only the minimum payment most of that is going toward the interest you owe. The average mortgage interest rate is 298 for a 30-year fixed mortgage influenced by the overall economy your credit score and loan type.

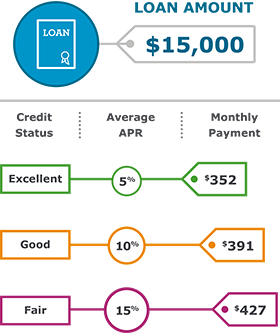

While it sounds high remember what these loans do they help you grow your real estate investment portfolio. High interest rates make it harder to pay off your debt because the interest increases substantially every month. An auto loans interest rate will depend largely on your credit score.

Those with a credit score between 781 and 850 saw an average new car interest rate of 265 in 2020. The lower your score the higher the interest rates charged by the bank because it indicates to the lender that you are a high risk lender with a history of defaulting on your monthly payments or erratic income. If you dont repay the loan the interest paid on that loan at least makes up for or reduces the lenders loss.

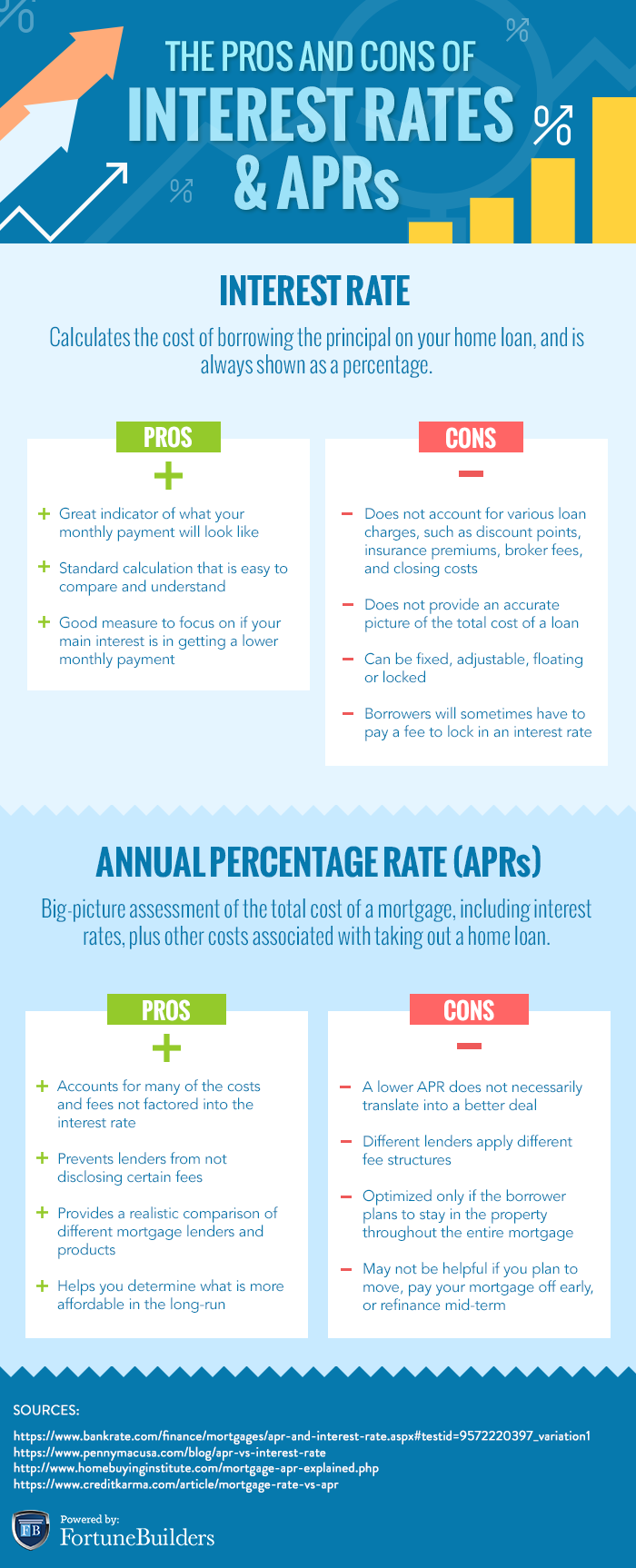

Thats when APR comes in. On a conventional loan its possible to go as low as 3. As mentioned above people with higher credit scores should qualify for loans at better rates.

With so many different types of business loans available for borrowers across a broad credit spectrum the answer isnt entirely clear. One point equals one percent of the loan amount. Hard money lenders charge 3 to 5 percent on most loans.

The first loan has an APR of 116 and the second loan has an APR. According to Nitzsche high-risk loans can have double- or even triple-digit interest rates. Your mortgage interest rate impacts how much youll pay for your home loan both on a monthly basis and overall.

When considering how much home you can afford its important to think about how much cash you have available to put down. Thats why its crucial to get the lowest rate possible. Your states usury laws determine the maximum interest rate that a lender is permitted to charge.

Insider logo The word Insider.

/what-does-apr-mean-315004-v3-jl-442b370734d44759ac43d09edcc3fb26.png) What Apr Tells You About A Loan

What Apr Tells You About A Loan

Seven Factors That Determine Your Mortgage Interest Rate Consumer Financial Protection Bureau

Seven Factors That Determine Your Mortgage Interest Rate Consumer Financial Protection Bureau

What Is The Average Personal Loan Interest Rate Creditrepair Com

What Is The Average Personal Loan Interest Rate Creditrepair Com

What Is A Good Interest Rate On A Personal Loan Forbes Advisor

What Is A Good Interest Rate On A Personal Loan Forbes Advisor

Average Auto Loan Interest Rates Facts Figures Valuepenguin

How Much Does A 1 Difference In Your Mortgage Rate Matter

How Much Does A 1 Difference In Your Mortgage Rate Matter

What S The Difference Between Mortgage Apr And Interest Rate

What S The Difference Between Mortgage Apr And Interest Rate

/calculate-Interestrate_393165-76ce02cdd3b0498280004aa12a7596f8.png) How To Calculate Interest Rates On Bank Loans

How To Calculate Interest Rates On Bank Loans

Average Auto Loan Interest Rates Facts Figures Valuepenguin

/what-are-interest-rates-and-how-do-they-work-3305855-FINAL2-2f4b8e003d8d475fa79182d2a5cd4aa4.png) Interest Rates Definition How They Work Examples

Interest Rates Definition How They Work Examples

Pros And Cons Of Apr Versus Interest Rate Fortunebuilders

Pros And Cons Of Apr Versus Interest Rate Fortunebuilders

/compound-interest-d0fbc3665a274591bc2cb29e769b3015.gif)

/GettyImages-140671550-56a636e83df78cf7728bdbc1.jpg)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.