Your lender is required by law to provide you with a good faith estimate. Anzeige Crédit Agricole CA next banks mortgage expertise for your Swiss financial project.

How To Remove A Name From A Mortgage When Allowed

How To Remove A Name From A Mortgage When Allowed

Then youll need to refinance again or have cash available to pay the balloon payment cautions.

Do you need a down payment to refinance mortgage. Closing costs and fees vary by loan and lender but they are actually rolled into the new mortgage so funds are very seldom required up front on a refinance. To refinance you would take out another 200000 loan from a. That means youre going to have to pay closing costs to finalize the paperwork.

On a 200000 loan youd be looking at anywhere from 4000 to 10000. For instance if you need to lower. Anzeige Crédit Agricole CA next banks mortgage expertise for your Swiss financial project.

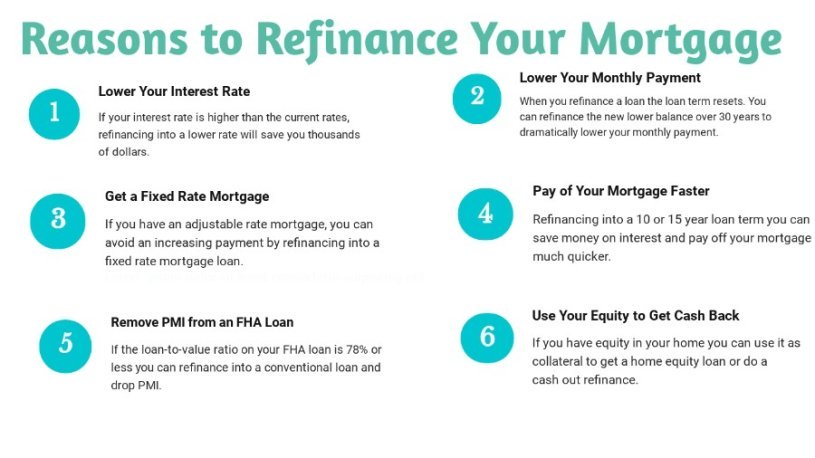

A cash-out refinance is a type of mortgage refinance that takes advantage of the equity youve built over time and gives you cash in exchange for taking on a larger mortgage. Depending on how much your home value has increased and how much of your current loan youve paid down though refinancing could help you eliminate mortgage insurance from your monthly payments. Skipping a monthly payment may be the most short-sighted of all reasons to refinance but improving your short-term cash flow is a close runner up.

When you refinance you get a new mortgage to. The equity is already yours which precludes any sort of down payment. When you refinance your mortgage youre basically taking out a new loan to replace the original one.

Say its the latter and you intend to remain in the home after the loan is paid off. You pay down your mortgage principal through your monthly mortgage payments. If youre paying monthly mortgage insurance because you made a low down payment or took out an FHA loan a refinance may help you eliminate or reduce private mortgage insurance PMI.

If you have less than 20 percent equity in a property your lender may require that. For example if youve reached 20 equity in your home you can refinance to a new conventional loan without paying PMI. There is no universal minimum down payment but the more you pay upfront the lower your monthly mortgage payments the lower the interest rate you will qualify for and the less likely you will.

Many refinances include some. These costs typically amount to 2 to 6 of the amount youre borrowing. Many homeowners consider refinancing their mortgage if they purchased the home without a 20 percent down payment.

Whether or not you put down a good faith deposit when you start your refinance process you have a right to know what the costs will be and if you put down a deposit how it will be used. Refinancing your home loan usually doesnt require any money from you. Do You Need to Put Money Down When Refinancing a Mortgage.

Homebuyers Are Making Bigger Down Payments. Our banking experts will be pleased to support you in the realisation of your projects. If youre already in a 30-year mortgage with no prepayment penalty you may not need to refinance at all -- you can shorten the life of your loan by just plowing more money into paying down.

Closing costs typically run between 2 and 5 of the loans value. For example say you owe 200000 on your mortgage. Boiled down refinancing is when you take out a new loan to pay a previous loan.

Our banking experts will be pleased to support you in the realisation of your projects. The possible exception may be when a debt tied to the original mortgage needs to be resolved before refinancing. Youll need to know the.

Every time you make a monthly payment on your loan you gain a bit more equity in your home. Verify your refinance eligibility Apr 29th 2021 When refinancing may not be a good idea Refinancing is a good idea only when it will do what you want it to do.

Should I Refinance My Mortgage Ramseysolutions Com

Should I Refinance My Mortgage Ramseysolutions Com

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg) 7 Bad Reasons To Refinance Your Mortgage

7 Bad Reasons To Refinance Your Mortgage

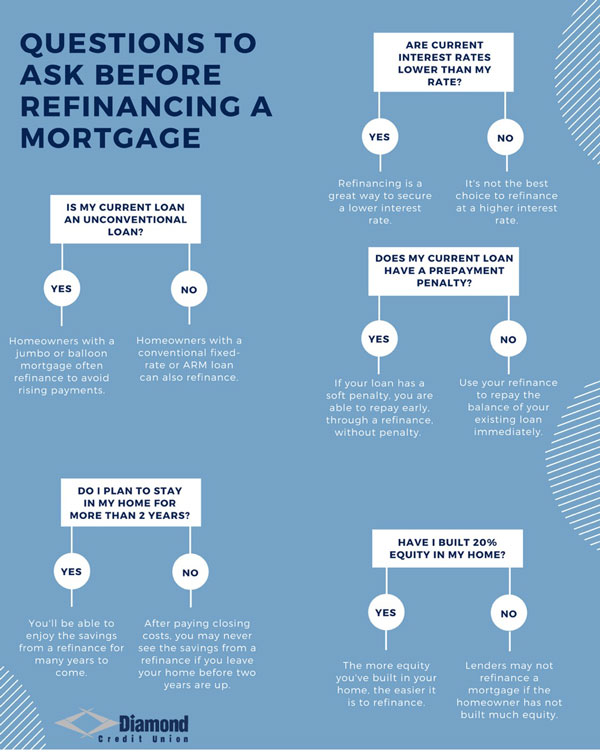

Should You Refinance Your Mortgage Yes Or No Diamond Cu

Should You Refinance Your Mortgage Yes Or No Diamond Cu

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Reasons To Use A Piggyback Loan 80 10 10 Loan Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Reasons To Use A Piggyback Loan 80 10 10 Loan Mortgage Rates Mortgage News And Strategy The Mortgage Reports

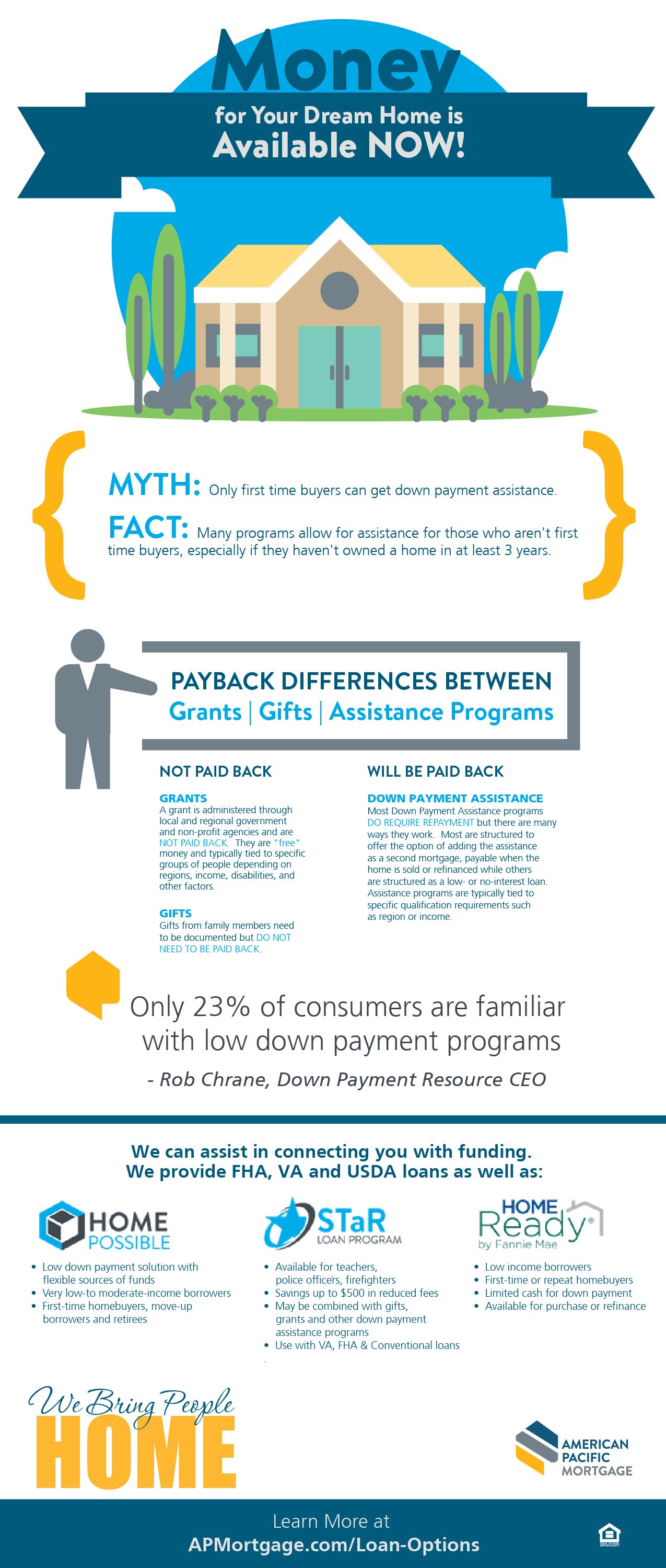

The Difference Between Gift Funds Grants Down Payment Assistance

The Difference Between Gift Funds Grants Down Payment Assistance

Mortgage Refinance Checklist Everything You Need To Refinance Your Home Pdf Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Refinance Checklist Everything You Need To Refinance Your Home Pdf Mortgage Rates Mortgage News And Strategy The Mortgage Reports

/choosing-a-down-payment-315602-Final-21f6f43a49084466afd65a24f1d288b9.png) Down Payments How They Work How Much To Pay

Down Payments How They Work How Much To Pay

Do I Need Money Down To Refinance My Mortgage Bankrate

Do I Need Money Down To Refinance My Mortgage Bankrate

Mortgage Refinance Guide When How To Refinance Mint

Mortgage Refinance Guide When How To Refinance Mint

How A No Cost Refinance Loan Really Works The Truth About Mortgage

How A No Cost Refinance Loan Really Works The Truth About Mortgage

How To Refinance Your Mortgage Loan When Rates Are Low Mint

How To Refinance Your Mortgage Loan When Rates Are Low Mint

Should I Refinance My Home Peglar Real Estate Group Mountain Home Ar

Should I Refinance My Home Peglar Real Estate Group Mountain Home Ar

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.