189 Then in 1970 a nearly unanimous Court sustained a state exemption from real or personal property taxation of property used exclusively for religious educational or. As stated by US Supreme Court Chief Justice Warren E.

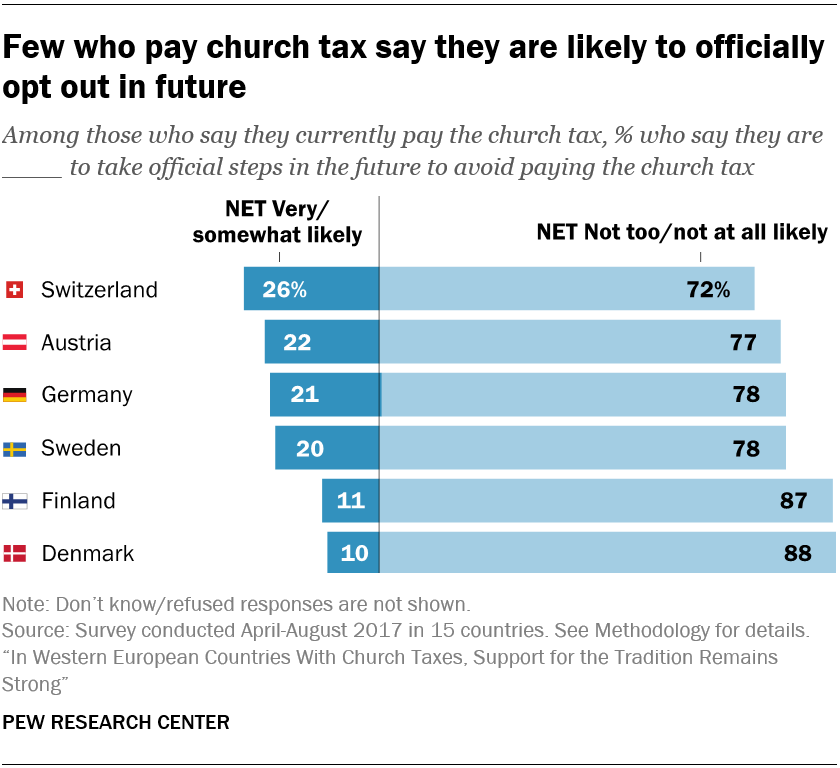

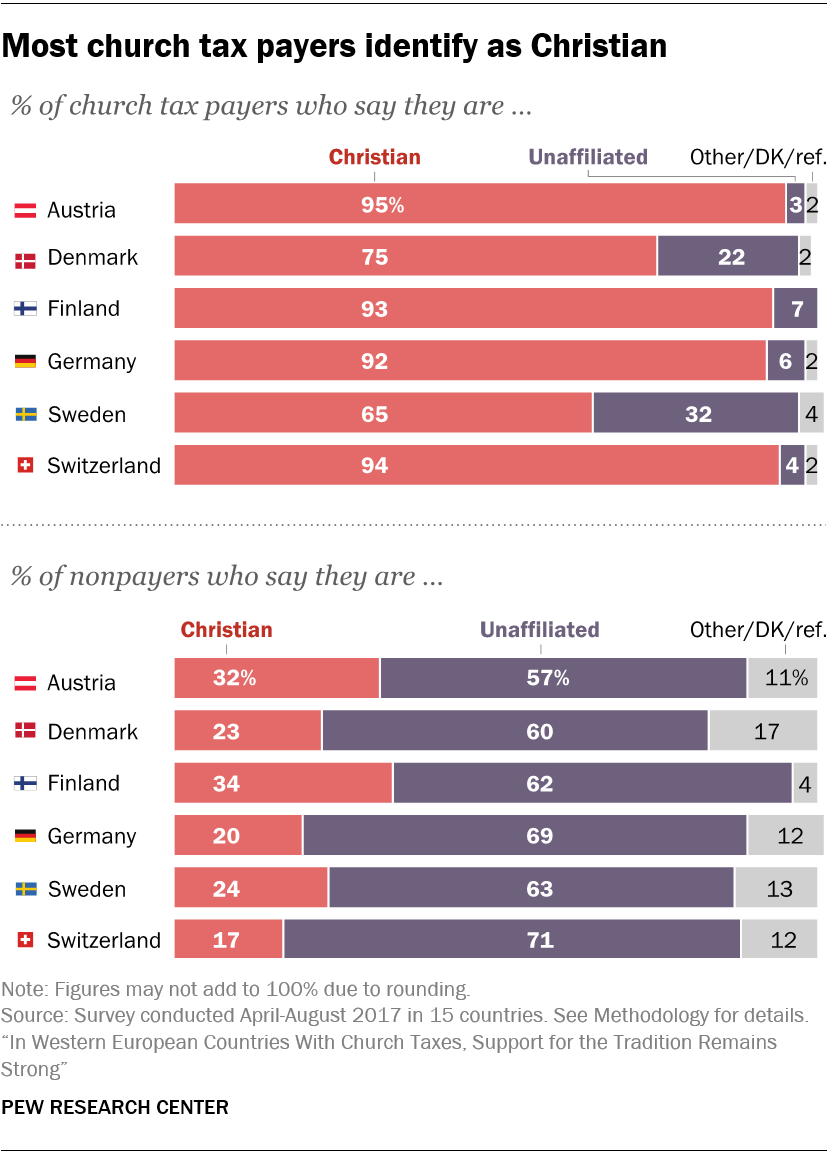

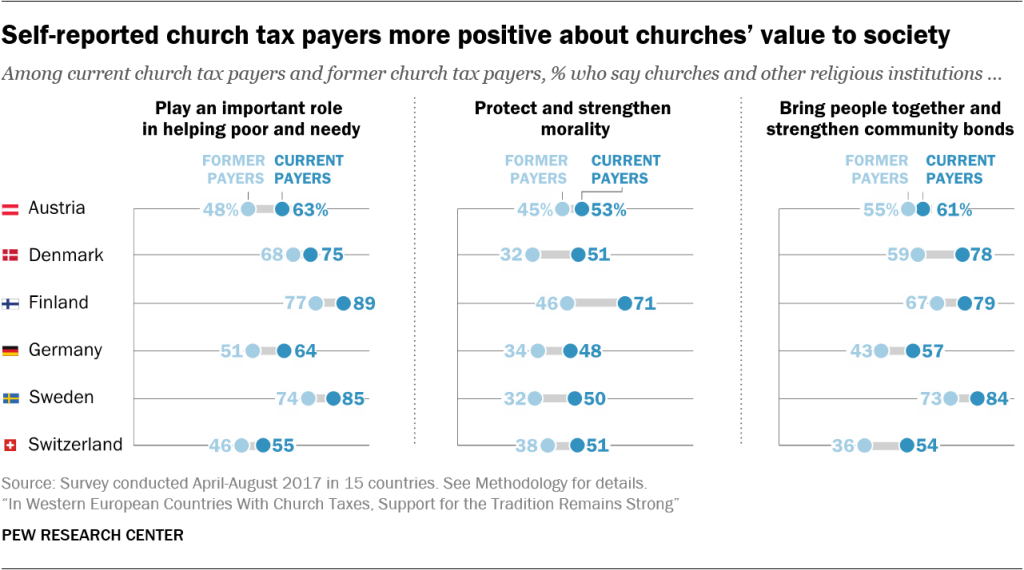

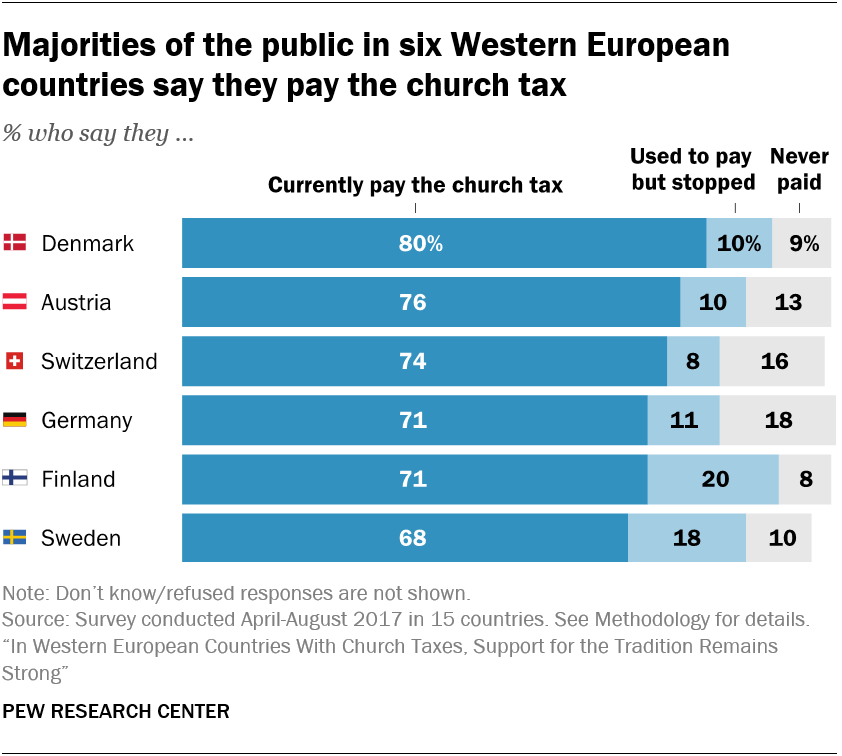

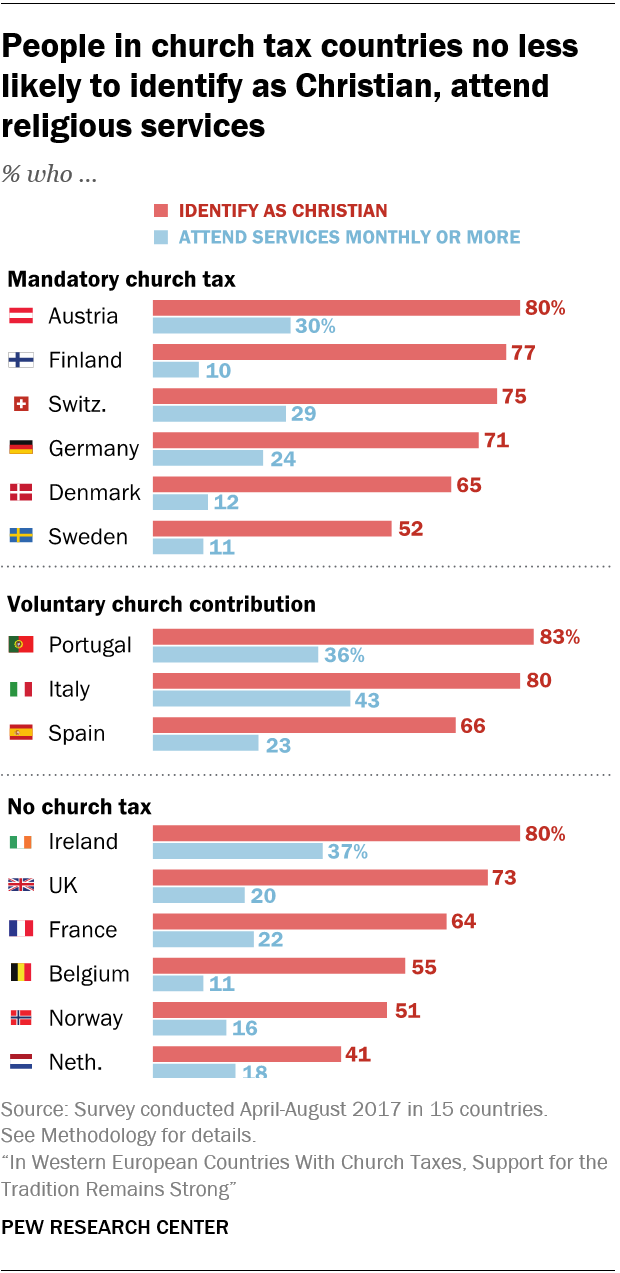

A Look At Church Taxes In Western Europe Pew Research Center

A Look At Church Taxes In Western Europe Pew Research Center

Tax information for charitable religious scientific literary and other organizations exempt under Internal Revenue Code IRC section 501 c 3.

Religious tax exemption. Registered religious institutions may be entitled to the following tax concessions. The only expression by a Supreme Court Justice prior to 1970 was by Justice Brennan who deemed tax exemptions constitutional. The exemption may also apply to leased personal property.

Tax Commission of the City of New York 1970 The grant of a tax exemption is not sponsorship since the government does not transfer part of its revenue to churches but simply abstains from. The problem of religious tax exemption keeps cropping up on the edge of various complaints. Tithes and offerings donations from members etc that are covered by income tax exemptions of such religious institution or church in Philippines along with.

The original reasons for granting churches tax-exempt status have not changed significantly over time even though the ins and outs of applying the tax exemption have certainly become more complicated. These tax benefits often come with conditions which are violated or abused by some churches. Often this falls under the umbrella of encouraging the activities of charitable or not-for-profit groups.

The Welfare Exemption for property owned by a religious organization and used exclusively for one or more. This means these groups are exempt from having to pay local state and federal taxes which could add 835 billion to government revenues in the US. Pro 5 A tax exemption for churches is not a subsidy to religion and is therefore constitutional.

Fringe benefits tax FBT concessions. Every state and the District of Columbia provide for tax exemptions for religious institutions and the history of such exemptions goes back to the time of our establishment as a polity. The only expression by a Supreme Court Justice prior to 1970 was by Justice Brennan who deemed tax exemptions constitutional because the benefit conferred was incidental to the religious character of the institutions concerned.

Tax exemptions of different types were common in the Colonial period. Tax-Exemption for Religious Institutions IRS regulations pertaining to churches and religious organizations fall under the umbrella of 501c3. Tax Exemptions of Religious Property.

If you or anyone in your tax household is member of a recognized religious sect or division who is opposed to acceptance of public benefits or private insurance benefits or who relies solely on a religious method of healing you can apply for a religious conscience exemption. Put differently to the extent such religious tax exemption may be constitutionally permitted and not constitutionally prohibited states are free to develop different exemption frameworks based on their own legislatively determined tax policy. Although using tax dollars for churches has a long and contentious past public sentiment seems far less concerned about the converse relationship between churches and taxing authorities namely the tax-exempt status of churches and other religious institutions.

A publication describing in question and answer format the federal tax rules that apply to group rulings of exemption under Internal Revenue Code section 501. Tax-Exempt Status Churches and religious organizations like many other charitable organizations qualify for exemption from federal income tax under IRC Section 501c3 and are generally eligible to receive tax-deductible contributions. Burger in his majority opinion in Walz v.

If churches were required to pay taxes on donations and other forms of income. Goods and services tax GST concessions. To qualify for tax-exempt status the organization must meet the following requirements covered in greater.

Exempting churches from taxes has been a part of American tradition since the inception of the country although tax exemption for religious organizations did not officially become law until 1894. If your organisation is a registered religious institution this will help you to determine the requirements for accessing tax concessions. So tax exemption for property tax income tax other kinds of taxes is a normal part of doing religious freedom in the history of the United States and its.

Ecclesiastical abuses increased community taxes following extensive exemption of church properties. Tax exemption for religious organizations Many governments have enacted lower tax arrangements or tax exemption for religious organizations. The Religious Exemption for property owned by a religious organization and used exclusively for religious worship services and certain school activities.

For the income tax exemption of the religious institutions or associations or churches in the Philippines RMO 23-2013 provides for the Application for Tax Exemption or Revalidation that would indicate specifically the income receipts revenues eg.

How Secular Humanists And Everyone Else Subsidize Religion In The United States Ryan T Cragun Phd

A Look At Church Taxes In Western Europe Pew Research Center

A Look At Church Taxes In Western Europe Pew Research Center

Church Tax Exemption Blessing Or Obstacle Fhgh Ministries

Church Tax Exemption Blessing Or Obstacle Fhgh Ministries

If American Churches Paid Taxes How Much Revenue Would That Generate Skeptics Stack Exchange

If American Churches Paid Taxes How Much Revenue Would That Generate Skeptics Stack Exchange

History Of Churches And Taxes Procon Org

History Of Churches And Taxes Procon Org

Church Taxes In Western Europe Key Takeaways Pew Research Center

Church Taxes In Western Europe Key Takeaways Pew Research Center

Is It Time We Started Taxing Churches

Is It Time We Started Taxing Churches

The Hidden Cost Of Tax Exemption Christianity Today

The Hidden Cost Of Tax Exemption Christianity Today

Church Taxes In Western Europe Key Takeaways Pew Research Center

Church Taxes In Western Europe Key Takeaways Pew Research Center

A Look At Church Taxes In Western Europe Pew Research Center

A Look At Church Taxes In Western Europe Pew Research Center

Religious Nonprofit Organizations And Churches Score

Religious Nonprofit Organizations And Churches Score

Philosophical Disquisitions Religious Liberty And Tax Exemptions Part 2

Philosophical Disquisitions Religious Liberty And Tax Exemptions Part 2

Should Religious Organizations Be Exempt From Tax Debate Org

Should Religious Organizations Be Exempt From Tax Debate Org

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.