Observers sometimes refer to a tax rebate as a refund of taxpayer money after a retroactive tax decrease. How do we calculate the amount of the tax relief refund.

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

It may be a universal tax cut or a targeted program that.

What is tax relief refund. Here are some examples of how EIS tax relief can increase your gains and decrease your losses from investments. The regular April 15 due date for filing returns and paying income taxes was postponed to July 15 2020 as part of the IRS response to the COVID-19 pandemic. Eligible taxpayers may receive up to 110 for individual filers and up to 220 for a married couple filing jointly.

EIS tax relief examples. If you received unemployment benefits in 2020 -- and paid taxes on those benefits -- you may be due extra money from the IRS as a refund. Tax relief applies to pension contributions charity donations maintenance payments and time spent working on a ship outside the UK.

The American Rescue Plan waived federal tax on up to 10200 of unemployment benefits per person received in 2020. The Virginia Tax Relief Refunds are the result of state legislation passed by the 2019 Virginia General Assembly in response to the federal Tax Cuts and Jobs Act. Tax relief is any government program or policy initiative that is designed to reduce the amount of taxes paid by individuals or businesses.

Optima Tax Relief LLC OTR will refund monies paid under the OTR Client Agreement within the first 15 calendar days without any penalty or obligation. What Is Tax Relief. Households with 150000 or more in.

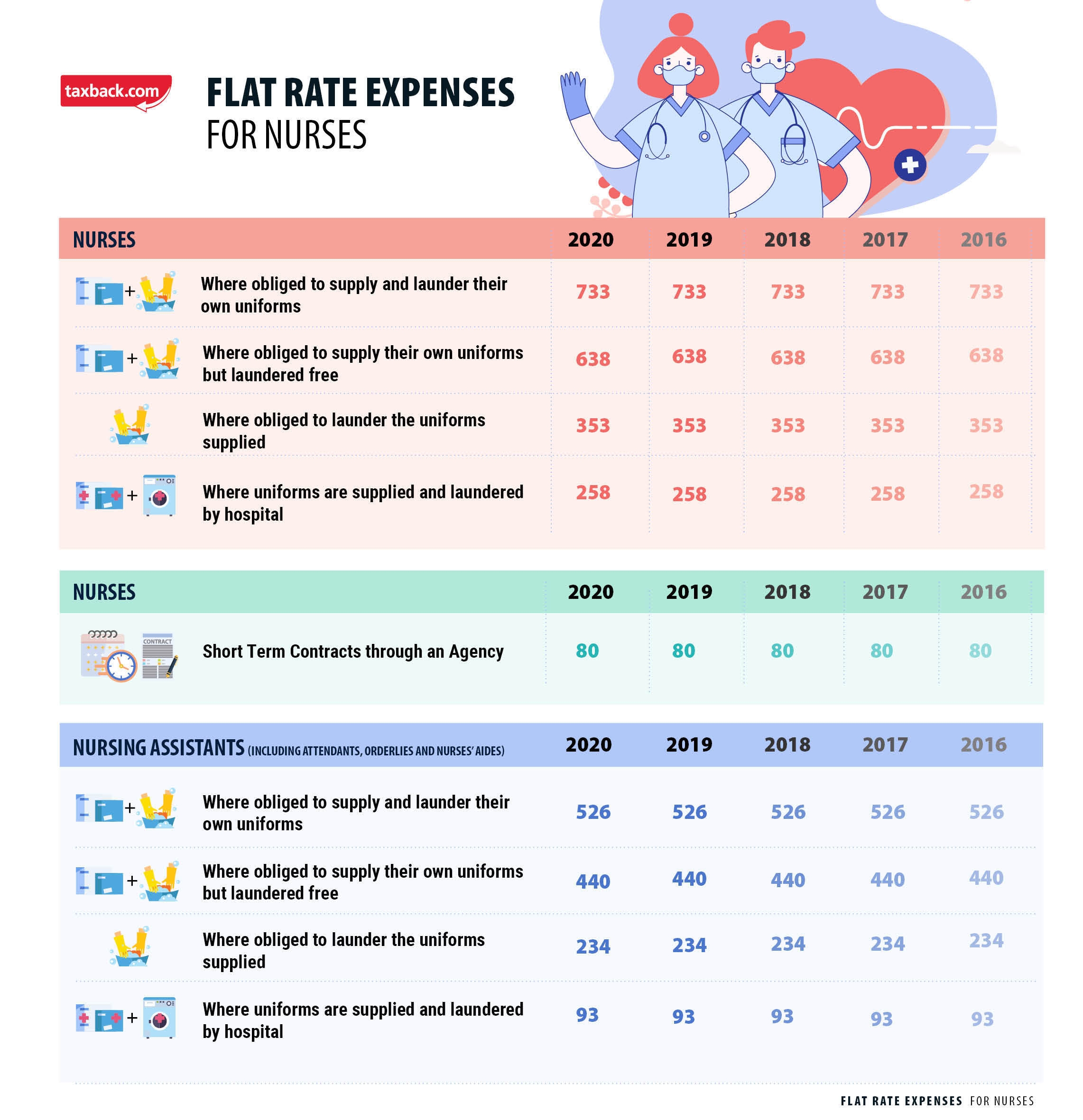

Nurse Tax relief for the cost of laundering of Uniform Nurse Tax relief for the cost of shoes and tights Nurse Tax relief for. This money-back guarantee ONLY applies to the fee paid towards the Investigation Phase and NOT for those enrolled with our Immediate Action Team or those that have executed a Resolution Phase Addendum. Victims of natural disasters such as hurricanes and wildfires are sometimes offered special tax relief as well.

The American Rescue Plan -- passed in March --. Tax relief really means setting up a payment plan or negotiating a settlement with the IRSits not about erasing your tax obligation. Back to page contents.

The legislation excludes only 2020 unemployment benefits from taxes. 2019 tax refund interest Many individual taxpayers whose 2019 tax returns show refunds will receive interest from the IRS. Taxpayers tend to look at.

A mileage claim can be made for the last four tax years. Nurse Tax Refunds includes. Any resulting overpayment of tax will be either refunded or applied to other outstanding taxes owed the IRS added.

The latest pandemic relief legislation signed into law on March 11 in the thick of tax season made the first 10200 of unemployment benefits tax-free. Any overpayment of tax will be either refunded or applied to other outstanding taxes owed. It also applies to.

Rather its about making it easier to take care of the tax debt you owe. These measures are more immediate than tax refunds because governments can enact them at any time during the year. Looking to get an idea of how much you could actually benefit from EIS.

Please note that eligibility for EIS tax relief depends on individual circumstances. The legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly and 10200 for all other eligible taxpayers. A tax refund is a reimbursement to a taxpayer of any excess amount paid to the federal government or a state government.

Tax Relief Refunds Up To 110 220 Mailed To Eligible Virginians - Del Ray VA - Those who qualify for a tax relief refund are receiving a check. What is a tax rebate. Tax relief is paid at the highest rate of income tax you pay.

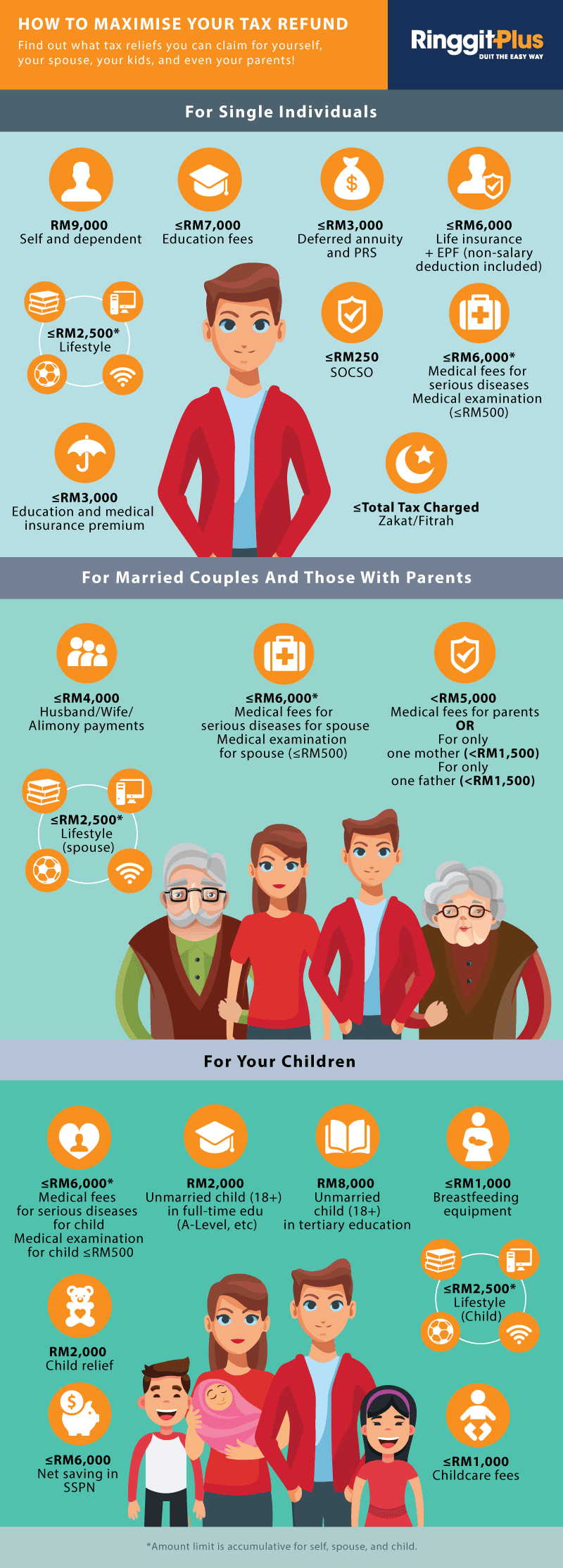

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

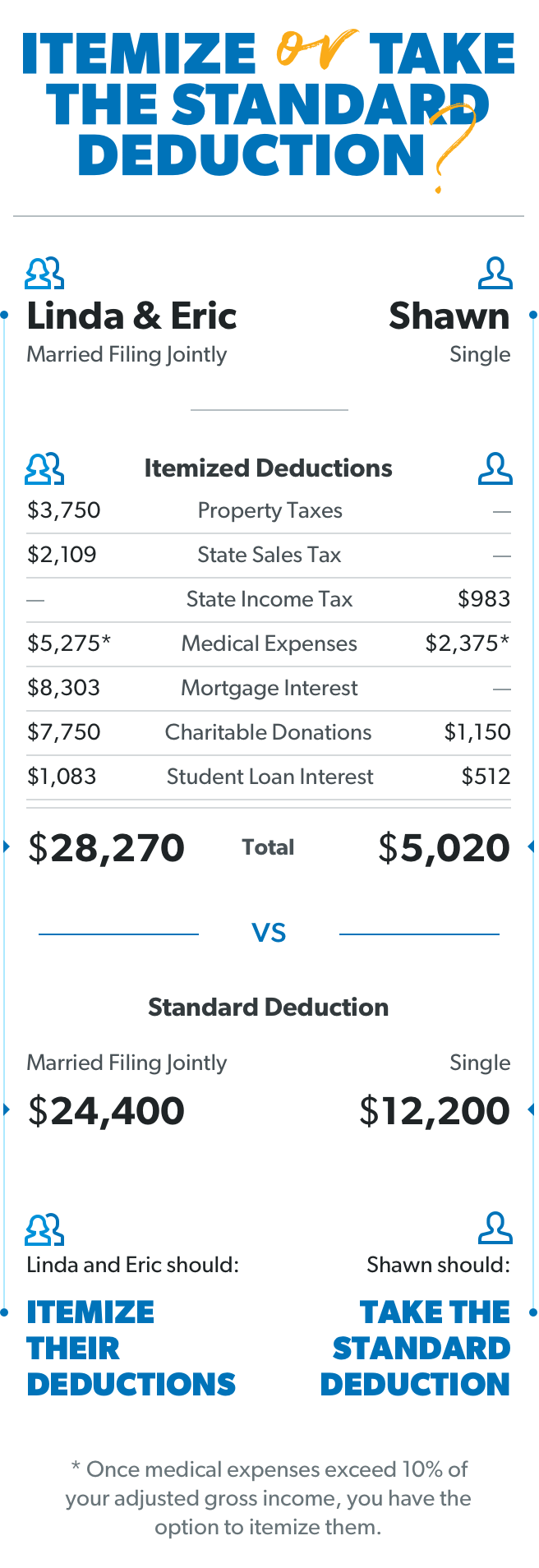

Tax Deductions Lower Taxes Increase Your Refund In 2020

Tax Deductions Lower Taxes Increase Your Refund In 2020

Sunanda Ten Sten0597 Profile Pinterest

Sunanda Ten Sten0597 Profile Pinterest

The Ultimate Tax Refund Guide Every Nurse Needs Right Now

The Ultimate Tax Refund Guide Every Nurse Needs Right Now

A State Tax Refund Might Be Coming Your Way Fredericksburg Today

A State Tax Refund Might Be Coming Your Way Fredericksburg Today

Five Reasons To Choose Direct Deposit Advance Tax Relief

Five Reasons To Choose Direct Deposit Advance Tax Relief

Facts About The Sales Tax Relief Act Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

Facts About The Sales Tax Relief Act Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

Difference Between Tax Exemption Tax Deduction And Tax Rebate The Economic Times

Difference Between Tax Exemption Tax Deduction And Tax Rebate The Economic Times

Everything You Should Claim As Income Tax Relief Malaysia 2020 Ya 2019

Everything You Should Claim As Income Tax Relief Malaysia 2020 Ya 2019

2019 Virginia Tax Relief Refund Virginia Tax

2019 Virginia Tax Relief Refund Virginia Tax

/taxable-refunds-4c861c1250a14e3b88fb645966cc6e61.png) Are Tax Refunds Taxable Unfortunately Yes Sometimes

Are Tax Refunds Taxable Unfortunately Yes Sometimes

Who Will Receive The Virginia Tax Relief Refund And When Thompson Greenspon Cpa

Who Will Receive The Virginia Tax Relief Refund And When Thompson Greenspon Cpa

Kfc Uniform Tax Rebate Uniform Tax Rebate

Kfc Uniform Tax Rebate Uniform Tax Rebate

What Is A Tax Deduction Ramseysolutions Com

What Is A Tax Deduction Ramseysolutions Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.