Changes for small business loans all commercial loans 1 million or less from banks and the small business loan size subcategories under 100000 and 100000 to 1 million. COVID-19 Small Business Loans The Small Business Administration SBA offers programs that can help your business if its been affected by the coronavirus pandemic.

Value Of Smb Loans In The U S By Lender Size 2013 Statista

Value Of Smb Loans In The U S By Lender Size 2013 Statista

Both these databases cover only a portion of the credit extended to small businesses annually excluding lending from nonbank institutions such as finance.

Small business loans united states. Interest rates range from 599 to 2999 APR. 100 federally backed loans to cover expenses like payroll rent and benefits. SBA provides a number of loan programs for small businesses.

Illinois small and mid-sized businesses are now qualified to apply for SBA Economic Injury Disaster Loans up to 2 million directly through the Small Business Administration. The SBA connects entrepreneurs with lenders and funding to help them plan start and grow their business. Short term loans SBA loans up to 250000 and lines of credit up to 100000.

Super Advance Capital is the go-to for small business loans. Seasonal line of credit. This publication covers all federal insured depository lending institutions filing Call.

With each passing year the internet becomes more and more vital to the operation of a well-run. Approval rates of small businesses loans in the US. During this difficult time for small businesses JOSS Capital is focused on providing assistance to as many small businesses as possible.

We support Americas small businesses. All you have to do is fill out a 15-minute online application then Lendio will use your application to match you with the right loans and lenders for your business. Information to small businesses and depository lenders of developments in the small business loan market.

GovLoansgov directs you to information on loans for agriculture business disaster relief education housing and for veterans. The disaster loan program is the only form of SBA assistance not limited to small businesses. Purchase of land or buildings.

Search for Government Loans. Small Business Loans Business lending solution in united states Amber Kay provide you with working capital for your business when banks wont. The uses of proceeds include.

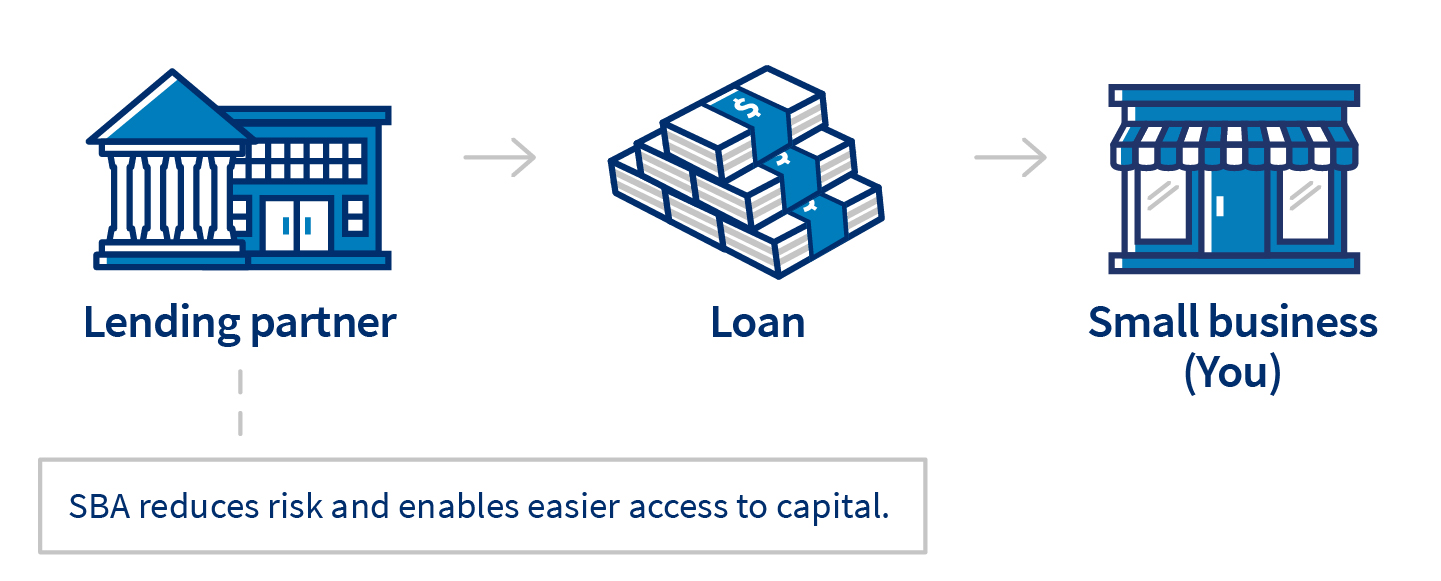

Highlights of the program include. Thats because Lendio is more like a loan matchmaker than a lenderwhich is great news for you. The SBA helps small businesses get loans.

Learn about loans and how to connect with a lender. 7a loans offer amounts up to 5000000. To qualify for a business loan from the lending club you must be in the business for more than 1 year with at least a 50000.

Lendio is the best business loan company for most businesses. Instead it sets guidelines for loans made by its partnering lenders community development organizations and. Small Business Loans Under The CARES Act.

We have 100s of small business loan. The CARES Act creates the Paycheck Protection Program which provides up to 349 billion to expand the Small Business Administrations SBAs existing 7a loan program to support new loan guarantees and subsidies. 2019 by lender type Published by Raynor de Best Jan 27 2021 This statistic presents the approval rates of small businesses loans in the.

The agency doesnt lend money directly to small business owners. We are also available to help you with the government application process and help small businesses take advantage of government loans due to the Coronavirus COVID-19 outbreak. They saw that there was a need to provide superior service and products to small businesses that larger banks and financial service providers were either not suited to do or did not see small businesses as an important focus.

Lending Club is the most popular peer to peer lender to small businesses. Use the federal governments free official website GovLoansgov rather than commercial sites that may charge a fee for information or application forms. Purchase of equipment fixtures.

The SBA works with lenders to provide loans to small businesses. The Small Business Administrations SBA disaster loans are the primary form of Federal assistance for the repair and rebuilding of non-farm private sector disaster losses. They started lending to small businesses in the year 2014.

You can ask for a minimum loan of 5000 to a maximum of 300000 from Lending Club. Refinancing debt for compelling reasons. 5 Top Trends for Small Business Loans in the United States and Around the World 1.

These loans are designed to be working capital loans used to pay ongoing business expenses. When you work with M1 Finance Solutions you feel as though you have your own team member working on your side to find the best pathway for your small business to be.

5 Top Trends For Small Business Loans In The Us Biz2credit

5 Top Trends For Small Business Loans In The Us Biz2credit

Number Of Outstanding Small Business Loans Small Business Loan Download Scientific Diagram

Number Of Outstanding Small Business Loans Small Business Loan Download Scientific Diagram

Guide To Small Business Covid 19 Emergency Loans U S Chamber Of Commerce

Guide To Small Business Covid 19 Emergency Loans U S Chamber Of Commerce

Number Of Small Business Loans In The U S 2013 Statista

Number Of Small Business Loans In The U S 2013 Statista

Small Business Administration Wikipedia

Quick Business Loans In The Usa Business Loans Small Business Loans Loan

Quick Business Loans In The Usa Business Loans Small Business Loans Loan

Business Finance Loans Visual Ly

Business Finance Loans Visual Ly

Best Small Business Loans Of 2021 U S News

Best Small Business Loans Of 2021 U S News

Value Of Small Business Loans In The U S 2014 Statista

Value Of Small Business Loans In The U S 2014 Statista

How To Get Small Business Loans In The United States Quora

Finding Reason In Monetary Policy And Quantitative Easing Tradimo News

Finding Reason In Monetary Policy And Quantitative Easing Tradimo News

Value Of Small Business Loans In The U S 2014 Statista

Value Of Small Business Loans In The U S 2014 Statista

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.