Your lender will send you an annual statement reporting the interest amount on your loan. Enter the amount of eligible interest you paid on line 31900 of your income tax return.

Higher Education Tax Benefits Do You Qualify

Higher Education Tax Benefits Do You Qualify

127 can also be used in 2020 for student loan repayment.

Student loan tax credit. Complete the Student Loan Debt Relief Tax Credit application. A non-refundable tax credit for student loan interest can only be claimed by the student even if it was paid by a related person. Student loan interest is interest you paid during the year on a qualified student loan.

The educational opportunity tax credit is equal to the lesser of annual loan payments or the amount due up to the benchmark loan payment amount made by the taxpayer on eligible loans included in the qualified graduates financial aid package. To qualify the taxpayer or their dependent needs to be. They are the American Opportunity Tax Credit and the Lifetime Learning Credit.

Unused interest amounts can be carried forward for 5 years. Filing Your Return - Students- Student loan interest Line 31900 Student Loan Interest. It includes both required and voluntarily pre-paid interest payments.

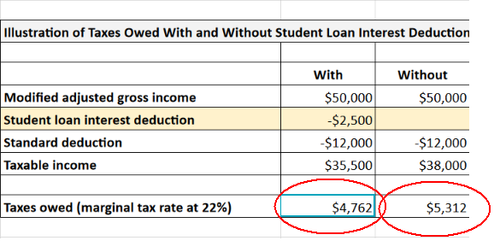

The deductions lower your taxable income and are called the Student Loan Interest Deduction and the Tuition and Fees Deduction. Employees dont have to. It allows eligible filers who paid interest on a qualified student loan during a tax year to deduct up to 2500 from their taxable income.

Income Tax Act s. You may claim those credits by entering the amount of your student loan interest on line 5852 of your provincial income tax return while Quebec residents will apply this amount to line 385 of their TP1. Your loans are considered in default if youre 270 days past due on your federal student loan payments or 120 days past due on your private student loan payments said Katie Ross education and development manager at nonprofit American Consumer Credit Counseling.

Federal Student Aid. 4th Stimulus check update student loan forgiveness child tax credit. Two other savings are tax credits which reduce the amount of taxes paid.

However that bill stalled in the House Committee on Ways and Means. You enter this amount on your tax return. Maryland taxpayers who maintain Maryland residency for the 2020 tax year.

The Student Loan Debt Relief Tax Credit Program for Tax Year 2020 is Closed STUDENT LOAN DEBT RELIEF TAX CREDIT. Claim any corresponding provincial or territorial credits. The student loan interest deduction is a tax break you may be able to claim on your federal income tax return.

In addition 40 of the credit or up to 1000 is refundable which means that someone can receive it even if they happen not to owe any taxes for the year. While the student loans eligible for the tax credit are administered by the federal and provincial governments theyre issued through regular banks and other lending sources. The funds must be applied to the employees own student debt not the debt of the employees spouse or dependents.

The AOTC allows people to take a student tax credit of up to 2500 for tuition fees and course materials they paid for during the taxable year for an undergraduate education. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans obtained to earn an undergraduate andor graduate degree ie associate bachelor masters. Tax credits and tax deductions can be lifesavers.

The 5250 that employees are permitted to receive tax-free for their education under Sec. But loans from relatives or an employer-sponsored retirement. To claim the non-refundable tax credit for student loan interest.

Before 2019 Line 31900 was line 319. The student loan interest deduction is available for both private and government student loans. You may deduct the lesser of 2500 or the amount of interest you actually paid during the year.

Jonathan Drake Reuters Employers can make tax-free contributions of up to 5250 a year or 43750 a month to their employees student debt through 2025. The Student Loan Interest Deduction Act of 2019 aimed to increase the deduction to 5000 or 10000 for married taxpayers filing joint returns when it was introduced to Congress in June 2019. From July 1 2020 through September 15 2020.

Forwardlooking Meanstesting With A Student Loan Tax Credit

Forwardlooking Meanstesting With A Student Loan Tax Credit

Forwardlooking Meanstesting With A Student Loan Tax Credit

Forwardlooking Meanstesting With A Student Loan Tax Credit

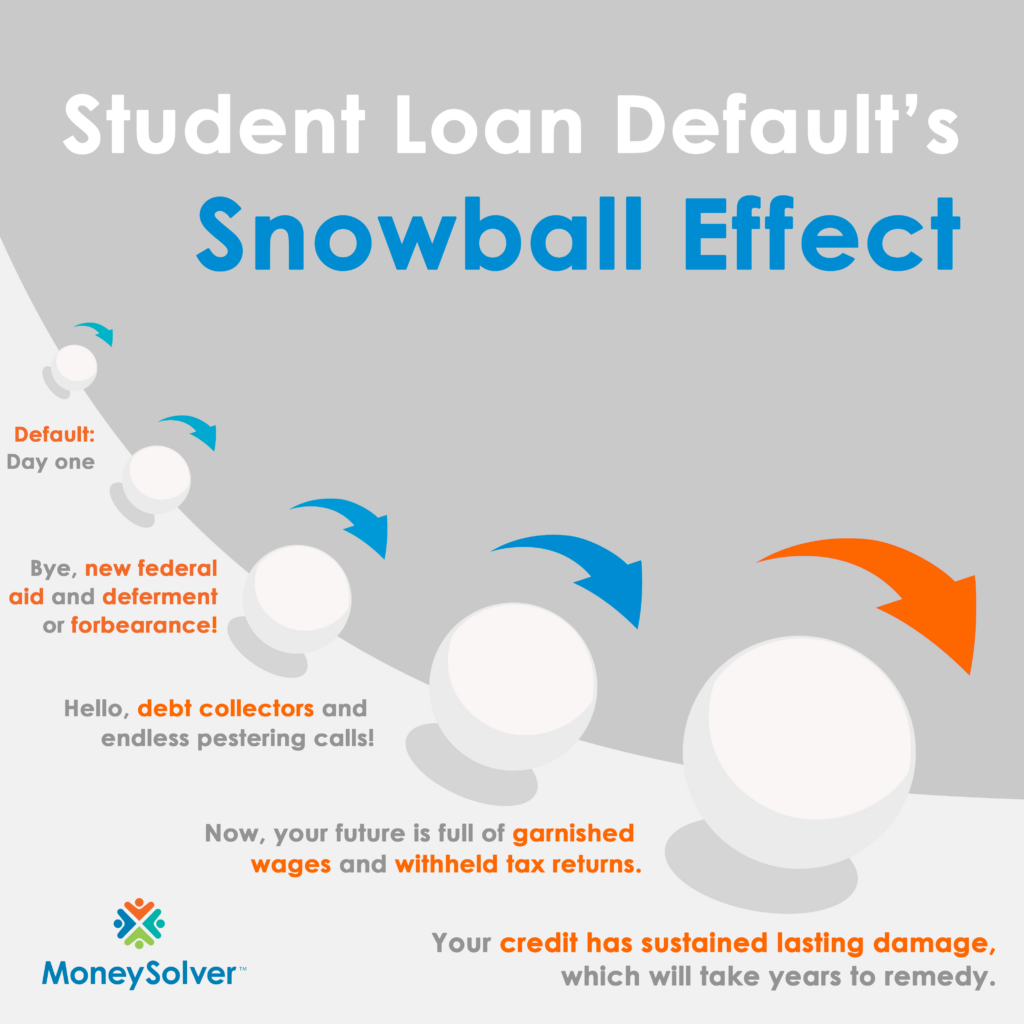

Student Loan Default Pit Could Make Things Worse

Student Loan Default Pit Could Make Things Worse

Your 1098 E And Your Student Loan Tax Information

Your 1098 E And Your Student Loan Tax Information

The Student Loan Interest Deduction Explained Student Debt Warriors

Student Loan Interest Deduction 2013 Priortax Blog

Student Loan Interest Deduction 2013 Priortax Blog

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif) Rules And Limits For The Student Loan Interest Tax Deduction

Rules And Limits For The Student Loan Interest Tax Deduction

Student Loan Tax Deductions Education Credits Save On Your Taxes

Student Loan Tax Deductions Education Credits Save On Your Taxes

Ecsi Student Loan Tax Incentives

Ecsi Student Loan Tax Incentives

Student Loan Repayment Student Loan Tax Tips For 2019

Student Loan Repayment Student Loan Tax Tips For 2019

Should I Use Tax Credits Or Deductions To Save On My Student Loans

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Is Student Loan Interest Tax Deductible Rapidtax

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.