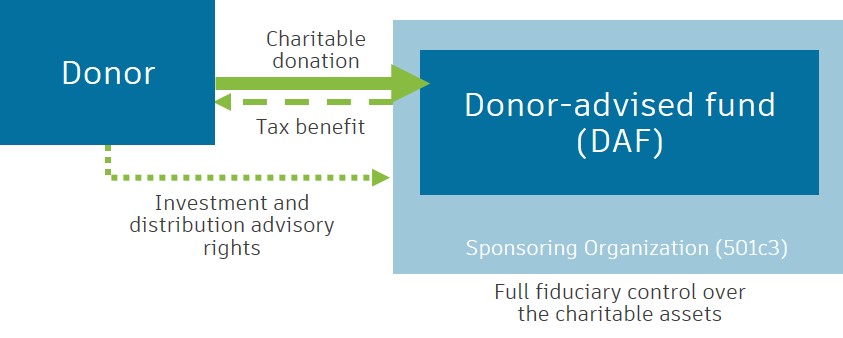

An investor can open an account with a DAF and contribute cash securities or other assets. The NFU Mutual Charitable Trust promotes and supports charities in the United Kingdom working in agriculture rural development and insurance.

Investment Options Fidelity Charitable

Investment Options Fidelity Charitable

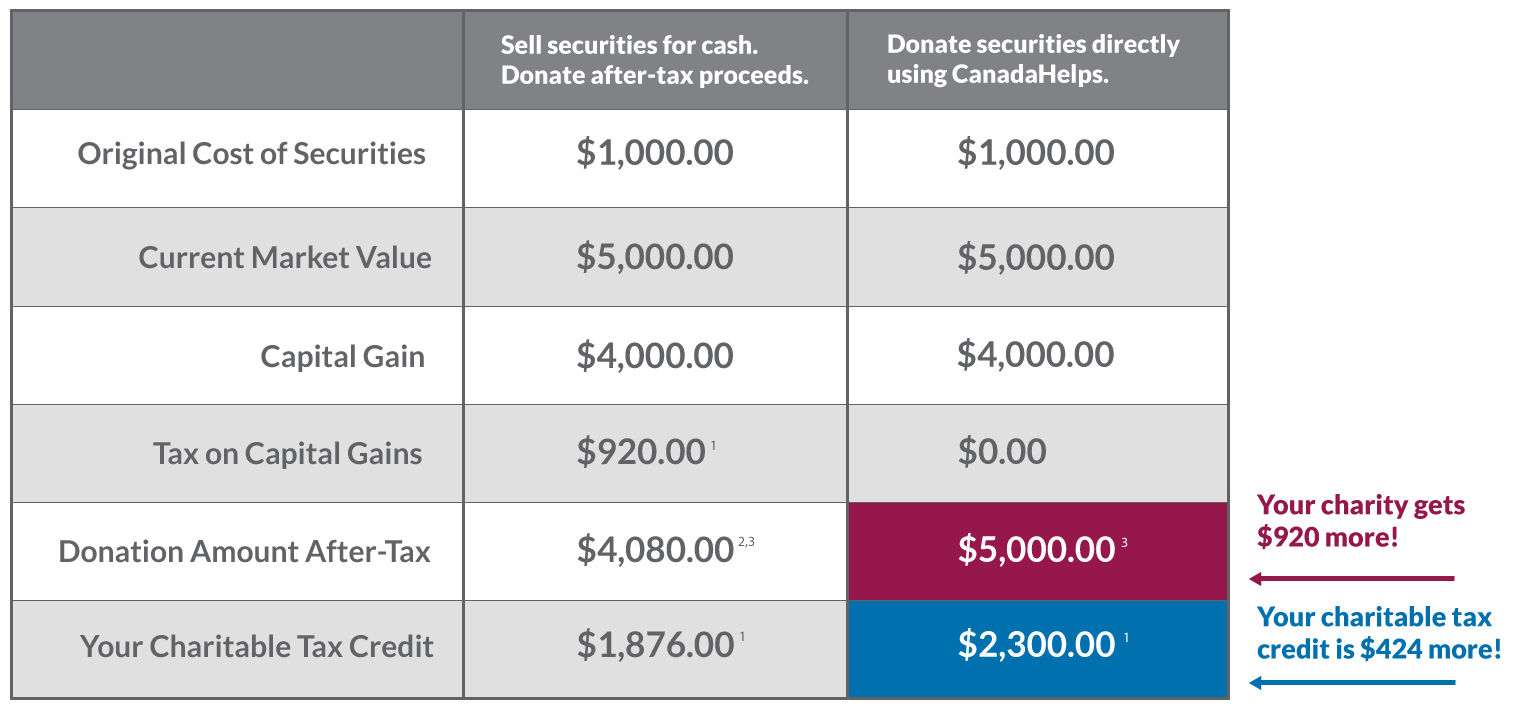

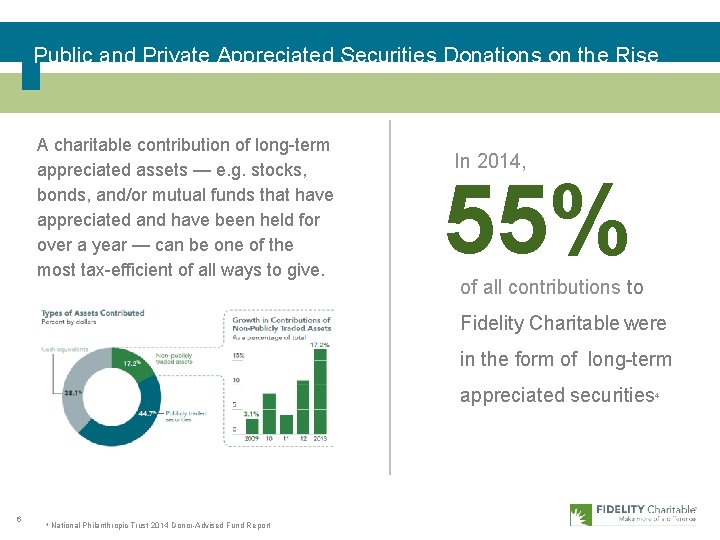

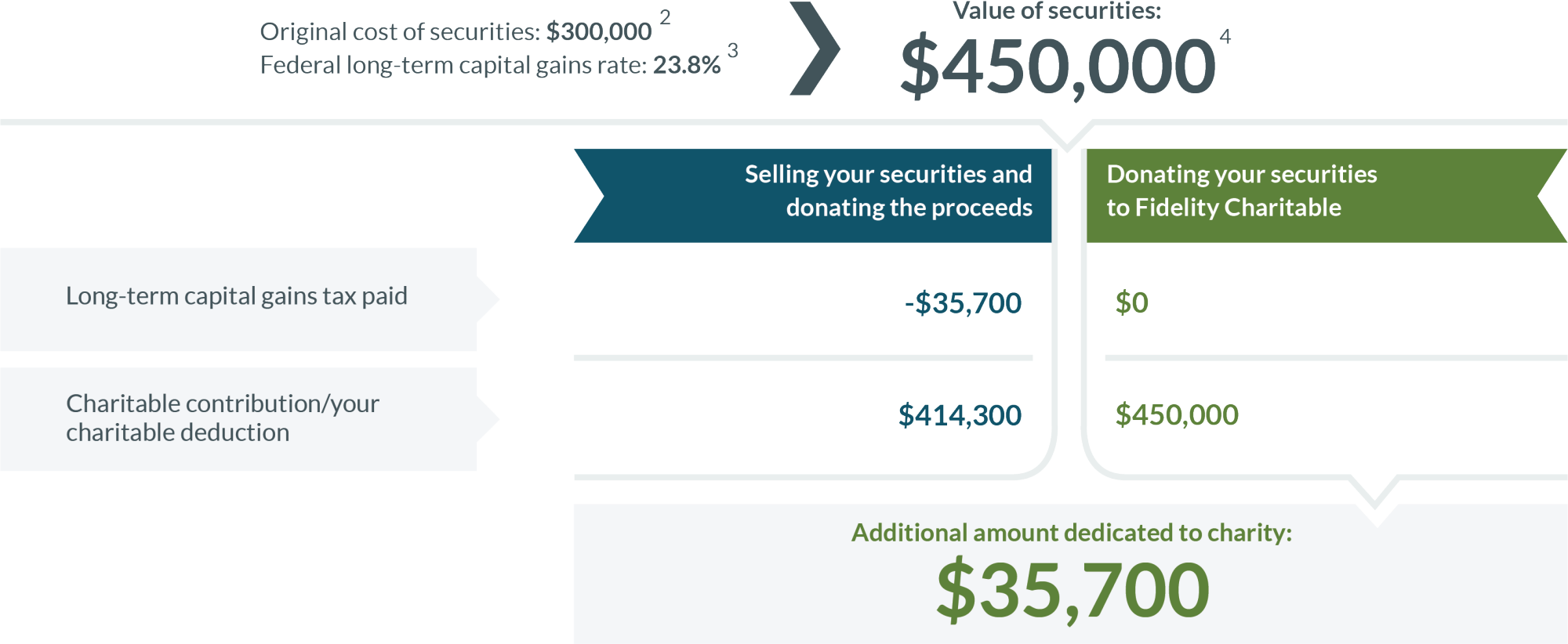

You can give stocks mutual funds and more for an immediate tax deduction and the potential to reduce capital gains.

Charitable mutual funds. Charitable gifts of mutual fund shares have become relatively commonplace. The top dogs make millions. A donor-advised fund DAF is a charitable giving account designed exclusively to invest grow and give assets to charities for meaningful and lasting impact.

Charity funds and what is allowed and what is disallowed under law. First it allows up to 300 given to a qualified charity to be claimed as an above-the-line deduction. Donor-advised funds are mutual fund-sponsored programs that administer charitable-giving programs on behalf of individual participants who can direct which charities should receive their contributions.

Securities that are received in good order are sold at the discretion of T. Make a bigger impact by donating securities and mutual funds. Although every effort has.

Give more give smarter With the Fidelity Charitable Giving Account you can give more than cash. You cant claim the standard deduction. Learn more about charitable tax credits here.

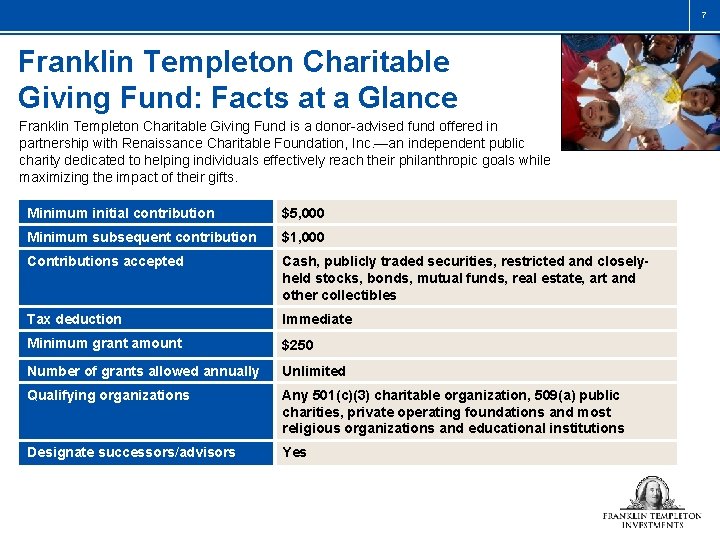

Fidelity Charitable is the brand name for the Fidelity Investments Charitable Gift Fund an independent public charity with a donor- advised fund program. Various Fidelity companies provide services to Fidelity Charitable. Schwab Charitable Fund is recognized as a tax-exempt public charity as described in Sections 501c3 509a1 and 170b1Avi of the Internal Revenue Code.

Rowe Price Charitable typically the next business day. It is incumbent upon the donor to provide all of the historical cost basis information for the total number of shares used in the creation of the gift annuity. Ill start with the skeptical proposition that any corporate support of any charitable or.

Rowe Price a world-class investment manager focused on delivering strong returns over time. After the Tax Cuts and Jobs Act which went into effect in 2018 increased the standard deduction many taxpayers had less incentive to donate to charities. Rowe Price Mail Code 17302 4515 Painters Mill Road Owings Mills MD 21117-4903 1 Owner Information Complete a separate form per IRA type.

Their compensation would make those in the charitable world envious beyond words. Mutual Fund Qualified Charitable DistributionIRA Mail to. Rowe Price Charitables investment pools are composed of mutual funds managed by T.

A donor-advised fund is a charitable investment account. Your contribution is tax-deductible and the assets in the account grow tax-free. The funds offer one way for you to maximize your charitable deductions allowing you the opportunity to take a deduction upfront before choosing specific charities as well as the opportunity to donate.

Rowe Price has invested significantly in people and systems to develop a comprehensive systematic and proactive process for evaluating environmental social and governance ESG factors across corporate. Box 17302 Baltimore MD 21297-1302 Express delivery only. Heres how it works.

A donation of securities or mutual fund shares is the most efficient way to give charitably. Itemized Deductions and Charitable Donations of Mutual Funds If you give shares of your mutual funds to charity and want to claim a tax deduction you must itemize your deductions on Schedule A and submit the schedule with your 1040. Is regulated by the state law Maharashtra Public Trusts Act 1950 under.

Falling fast and furious and NGOs are often in a dilemma where to invest. Please be aware that Schwab Charitable has exclusive legal control over the assets you have contributed. Stock contributions generally settle three days after receipt and mutual fund contributions generally settle two days after receipt.

In both cases net proceeds would reflect in an account balance the business day after settlement. Investment Opportunities for Charitable Organizations. Please be aware that Schwab Charitable has exclusive legal control over the assets you have contributed.

This isnt advantageous for every taxpayer. With a donation of securities or mutual funds capital gains tax does not apply allowing you to give more and avoid paying capital gains taxes. Schwab Charitable Fund is recognized as a tax-exempt public charity as described in Sections 501c3 509a1 and 170b1Avi of the Internal Revenue Code.

Note the net proceeds amount equals the actual. Fidelity Charitable and Fidelity are registered. The new legislation allows tax deductions on two types of charitable gifts.

Charitable Families Charitable Fund Families. You donate assets into a DAF account and recommend how those assets should be invested. You can even donate the rewards from your Fidelity Visa Signature Card.

Contributions made to Schwab Charitable Fund are considered an irrevocable gift and are not refundable. The Trustees are particularly interested in initiatives in the areas of education of young people in rural areas and relief of poverty within rural areas and will focus on providing funding to larger initiatives which would have a significant impact on the rural community. In summary mutual funds that have appreciated over time can indeed be used successfully as the funding assets for the establishment of charitable gift annuities but the gift planner should be aware of the need for the donors full tax accounting history.

The essential differenceat least for the momentis that the transfer of mutual fund shares can take significantly. Appreciated mutual fund shares held for more than a year provide the same income tax deduction for the value of the gift as stocks held individually without being taxed on the capital gain. Contributions made to Schwab Charitable Fund are considered an irrevocable gift and are not refundable.

Single Charity Fund Messenger Films

Single Charity Fund Messenger Films

Guide To Donating Stocks Securities And Mutual Funds Canadahelps

Guide To Donating Stocks Securities And Mutual Funds Canadahelps

Donor Advised Funds What They Are Why You Should Consider One

Donor Advised Funds What They Are Why You Should Consider One

How To Use Donor Advised Funds To Make Impact Investments

How To Use Donor Advised Funds To Make Impact Investments

Sharpen Your Competitive Edge With Charitable Planning Karla

Sharpen Your Competitive Edge With Charitable Planning Karla

Investors Should Carefully Consider A Funds Investment Goals

Investors Should Carefully Consider A Funds Investment Goals

Impactassets Donor Advised Fund

Impactassets Donor Advised Fund

Fidelity Charitable Giving Account Fidelity

Fidelity Charitable Giving Account Fidelity

How To Use Donor Advised Funds To Make Impact Investments

How To Use Donor Advised Funds To Make Impact Investments

Mutual Funds For Non Profits Bright Funds Wants To Be The Vanguard For Charitable Giving Techcrunch

Mutual Funds For Non Profits Bright Funds Wants To Be The Vanguard For Charitable Giving Techcrunch

Donating To A Vanguard Charitable Donor Advised Fund From A Vanguard Brokerage Account Physician On Fire

Donating To A Vanguard Charitable Donor Advised Fund From A Vanguard Brokerage Account Physician On Fire

Charitable Giving Investment Example

Donating Stock To Charity Fidelity Charitable

Donating Stock To Charity Fidelity Charitable

/GettyImages-494146669-56a6948a5f9b58b7d0e3aeef.jpg) The Limitations Of Donating Mutual Funds To Charity

The Limitations Of Donating Mutual Funds To Charity

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.