Payments less than 30 days late are unlikely to appear in your credit report. How long does a late payment stay on your report.

How Long Do Late Payments Stay On Your Credit Report Badcredit Org

How Long Do Late Payments Stay On Your Credit Report Badcredit Org

Late payment may stay on your credit reports for up to 7 years and can affect your credit scores during the whole period it is there.

/remove-credit-report-late-payments-4134208_color-6a8317fc55d340da8ecb4dfa8853aab7.gif)

How long are late payments on your credit report. Generally a late payment on your credit card account will remain on your credit history for up to seven years even if you pay the past-due balance in full. You might face penalties if you miss the due date by even just one day but a late payment wont harm your credit if you bring your account up to date before the 30-day window closes. This is also known as previous high rate based on the system used in Canada to rate payments.

Like most negative information late payments can remain on your credit report for up to seven yearsand its an ugly blemish to carry around. In Canada a late payment can stay on your credit report for up to six years. However some of our partner offers may have expired.

Missing payments and late payments are definitely items that hurt your credit score. Late payments tend to have a big effect when they first appear and you could work to build your credit while waiting for late payments. However there is no definite time period set in place for how long.

How long do late payments stay on a credit report. What should you do if you miss a payment. After that payments get categorized 30 days 60 days 90 days and so on until the lender resorts to a charge-off.

The late payment will usually appear on your credit reports starting from the date of the missed payment. The average time for a late payment to hit your credit report takes about 30 days from the date it happens. Most creditors place late payments in one of the following categories according to MyFICO.

How Long Late Payments Stay On the Credit Report. According to Equifax your history of late payments accounts in collection and tax liens stay on your credit file for seven years. Bankruptcy stays on your credit report for 10 years from the date filed.

Even if you repay overdue bills the late payment wont fall off your credit report until. Lenders bankers and other financial institutions take late payments very seriously. However the date when the credit reporting agencies start counting the six years for the negative information on your credit report differs.

Since payment history makes up 35 of your credit score even a single late payment can make a significant impact. A late payment also known as a delinquency will typically fall off your credit reports seven years from the original delinquency date. The late payment remains on your Equifax credit report even if you pay the past-due balance.

Late payments are reported to the credit bureau and added to your credit report at least 30 days after the payment due date. Your creditor can tell you its policy for reporting late payments to the credit bureaus. Not all late payments have the same impact though.

Late payments remain on a credit report for up to 6 years from the date reported. When Do Late Payments Show Up on Your Credit Report. If you had a 30-day late payment reported in June 2017 and bring the account current in July 2017 the late.

Late payments remain on your credit reports for seven years from the original date of the delinquency. A late payment appears on your credit report when youve gone at least 30 days past the due date. Typically a late credit card payment that gets reported to any or all of the three major credit bureaus can stay in your credit report s for up to seven years from the date of the original delinquency.

There are many reasons why you should NEVER miss a credit card payment. The content on this page is accurate as of the posting date. With Equifax the clock starts ticking at the date of your last activity such as when you made your last payment.

A foundational cornerstone of good credit payment history accounts for 35 of your total score more than any other individual factor. A late payment typically stays on your credit report for up to seven years according to information from the three major credit bureaus Equifax Experian and TransUnion. Paying 90 days late has a more severe impact than paying 31 days late.

Some creditors or lenders may not report late payments until they are 60 days past due. A late credit card payment stays on your credit report for seven years.

How Long Does It Stay On My Credit Report Ovation Credit Repair Services

How Long Does It Stay On My Credit Report Ovation Credit Repair Services

How Long Does Bad Credit Stay On Your Record Business 2 Community

How Long Does Bad Credit Stay On Your Record Business 2 Community

:max_bytes(150000):strip_icc()/remove-credit-report-late-payments-4134208_color-6a8317fc55d340da8ecb4dfa8853aab7.gif) How To Remove Late Payments From Your Credit Reports

How To Remove Late Payments From Your Credit Reports

/remove-credit-report-late-payments-4134208_color-6a8317fc55d340da8ecb4dfa8853aab7.gif) How To Remove Late Payments From Your Credit Reports

How To Remove Late Payments From Your Credit Reports

How Long Do Late Payments Stay On Your Credit Report

How I Got 4 Late Payments Removed From My Credit Report In 30 Days

How I Got 4 Late Payments Removed From My Credit Report In 30 Days

/remove-credit-report-late-payments-4134208_color-6a8317fc55d340da8ecb4dfa8853aab7.gif) How To Remove Late Payments From Your Credit Reports

How To Remove Late Payments From Your Credit Reports

/remove-credit-report-late-payments-4134208_color-6a8317fc55d340da8ecb4dfa8853aab7.gif) How To Remove Late Payments From Your Credit Reports

How To Remove Late Payments From Your Credit Reports

How Long Will Negative Information Stay On Our Credit Reports Nationwide Credit Clearing

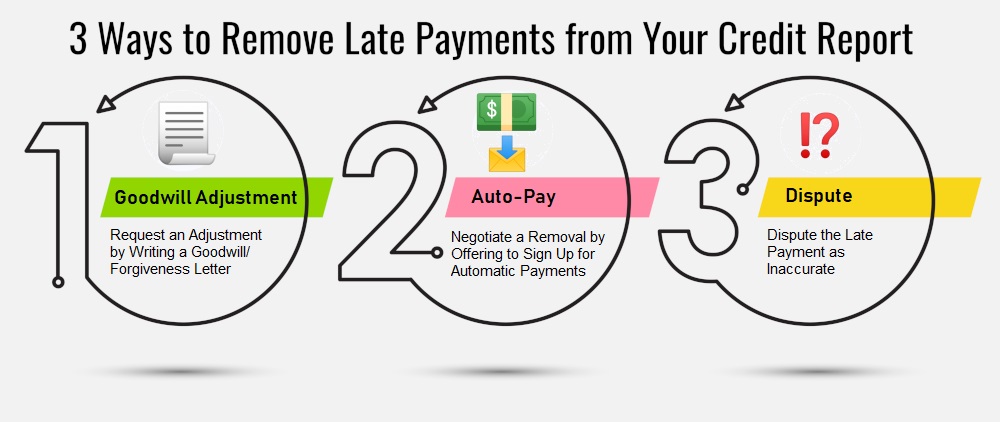

How To Remove Late Payments From Your Credit Report

How To Remove Late Payments From Your Credit Report

How Long Do Negative Items Stay On Your Credit Report Blue Water Credit

How Long Do Negative Items Stay On Your Credit Report Blue Water Credit

How To Remove Late Payments From Your Credit Report

How To Remove Late Payments From Your Credit Report

How To Remove Late Payments From Your Credit Report

How To Remove Late Payments From Your Credit Report

How To Remove Late Payments From Your Credit Report

How To Remove Late Payments From Your Credit Report

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.