Make sure you buy the best income protection insurance policy for your needs not just the cheapest policy. That means you know exactly what youll have to pay each month for your income protection cover.

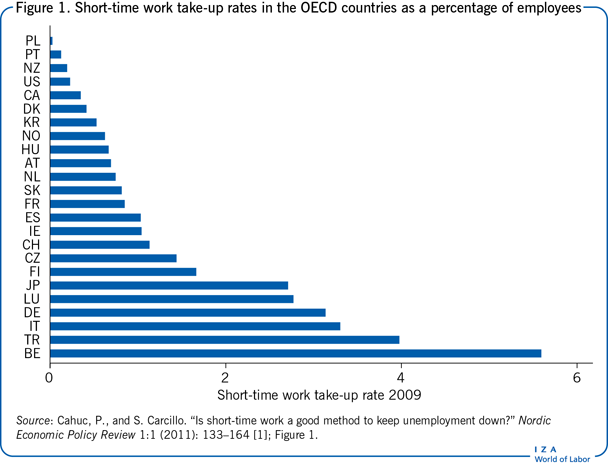

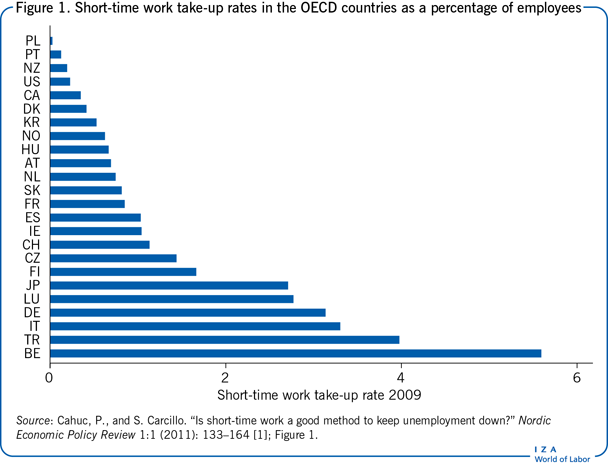

Iza World Of Labor Short Time Work Compensation Schemes And Employment

Iza World Of Labor Short Time Work Compensation Schemes And Employment

If you choose a longer waiting period.

Best job loss insurance. With the job market in the country being so fragile and volatile job insurance could be a sensible option. But IncomeAssure pays benefits based on your salary -up to a maximum of 250000 - and your job category as well as the states current level of unemployment. There are other types of loss of income insurance.

Jobs 4 days ago However most job loss mortgage protection insurance polices only cover your mortgage costs for six to 12 months up to a certain ceiling. Inputs from Navneet Dubey. Several insurance products such as critical illness personal.

What is job loss insurance. Directors are responsible for coordinating the development of an organizations risk management programs. Job Loss Insurance is a form of payment protection that is typically available as an add-on feature to Credit Protection Life Insurance for mortgages personal loans and credit card products.

One comes from the government one you can buy separately and a third you can buy for your mortgage. Health Insurance After a Job Loss. Guaranteed policies have fixed monthly premiums.

The lack of insurance agents helps keep the premiums down. When you leave or lose your job a window opens to the governments Health Insurance Marketplace where you can shop for plans in your state or region. There are three types of job loss insurance that can help qualified unemployed workers.

Safe Loan Shield by Royal Sundaram. If youve bought an unemployment insurance policy and you lose your job youll be paid a tax-free monthly income that starts after youve been off work for a pre-agreed waiting period. You might have taken out this type of insurance along with your mortgage.

Irrespective of the size or yield of your portfolio your investment is the best insurance against a job loss if it can be easily liquidated. Home Suraksha Plan by HDFC Ergo. Mortgage unemployment insurance also called job loss mortgage insurance.

The premium of master policy varies between 3 to 5 of the coverage. It typically starts to pay your mortgage repayments three months after your earnings stop and continues to pay out for up to 12 months. You pay monthly premiums and if you lose your job you get a substantial boost in weekly unemployment benefits as a result of owning this insurance policy.

The longer this period is the lower your premium so its worth looking at a couple of options. There are three types of insurance available if you lose your job. Mortgage payment protection insurance MPPI.

COBRA is still offered to employees who are laid off or terminated from a job but these days there is another more permanent solution. Besides the contingency fund short-term investments with flexible liquidity would help you sail through difficult times easily. Some of the plans that are coupled with job insurance are.

These include guaranteed policies reviewable policies and age-related policies. Commonly job-loss insurance is available as a rider with polices that cover larger risks such as accident and critical illness. Job Loss Mortgage Protection Insurance.

Now you can decide to avail Job Loss Insurance Cover depending on the premium and the probability of job loss. For instance if your monthly mortgage bill was 1000 per month Policy A may pay out 600 while. From 5 a month for a 1500 lump-sum payout to 30 a month for a 9000 benefit with a lifetime maximum payout of 24000.

How does unemployment insurance work. Having your job made redundant can lead to significant financial issues if you do not have the right unemployment insurance in place. This is sometimes called the deferred period.

Job Loss Insurance can also be available in conjunction with Disability Insurance as one package. Therefore the overall cost of your insurance will depend on how long you are paying monthly or annual premiums before you are eligible to make a claim. The premium of Job Loss Insurance Cover is another 3 to 5 of the total premium but it is also dependent on other factors.

Mortgage protection insurance can also protect you when you lose your job as its designed to kick in to cover you against any mishaps that may. The actual cost of losing your job will vary from person to person so the cost of unemployment insurance will vary. Secure Mind by ICICI Lombard.

Although job insurance serves as a temporary relief it saves us from the mental trauma of job loss. In short of total coverage the premium for add-on cover is between 1 to 25 We. Although it does help encourage reluctant home buyers so this insurance indirectly benefits lenders as well.

Top Paying Insurance Underwriting Jobs. Working with attorneys insurance groups and individuals they oversee the development of risk management programs to ensure compliance with best practices and legal regulations. If you involuntarily lose your job payments are applied toward your mortgage personal loan or credit card.

Mortgage protection insurance and loss of job. Unemployment Protection Insurance unlike mortgage insurance is designed to help the buyer rather than the lender. Mortgage unemployment protection insurance does what you might think it does protects the buyer if they are unable to pay their mortgage due to a job loss until they.

Anti Inflammatory Diet Lifestyle Guide

Anti Inflammatory Diet Lifestyle Guide