New Jersey to Receive 7 Million through Multi-State Settlement With Chase Bank over Credit Card Debt Collection Practices. Please contact the claims.

How To Settle Credit Card Debt With Chase Bank Chase Credit Card Debt Relief Gamez Law Firm

How To Settle Credit Card Debt With Chase Bank Chase Credit Card Debt Relief Gamez Law Firm

Customers who notify Chase that they are working with a debt settlement company will be advised of this policy and encouraged to work with Chase directly or to contact a non-profit 501 c 3 licensed credit counseling agency.

Chase bank credit card debt settlement. Chase like any lender would prefer to get some amount of money rather than write off a debt completely so you have some leverage in negotiating an settlement thats agreeable to both sides. The relief comes in many forms. Chase has taken the extremely rare move of.

Find out if you qualify for this settlement now. According to court documents the claim submission deadline has passed. Many offer rewards that can be redeemed for cash back or for rewards at companies like Disney Marriott Hyatt United or Southwest Airlines.

Learn how to lower your credit card debt with Chase with these helpful tips from debt lawyer Daniel Gamez. Debt consolidation means to bring all of your balances to a single bill and it can be a useful way to manage your debt. Balance liquidation plans and debt settlement are both available on a Chase credit card.

If you are unable to meet multiple credit card payments as your interest payments increase or if you simply want to move from a credit lifestyle to a savings lifestyle it may be time to consolidate your credit card payments so you can erase your credit card debt. View the outcome letter cost time to complete. If you do then you should pay the debt off.

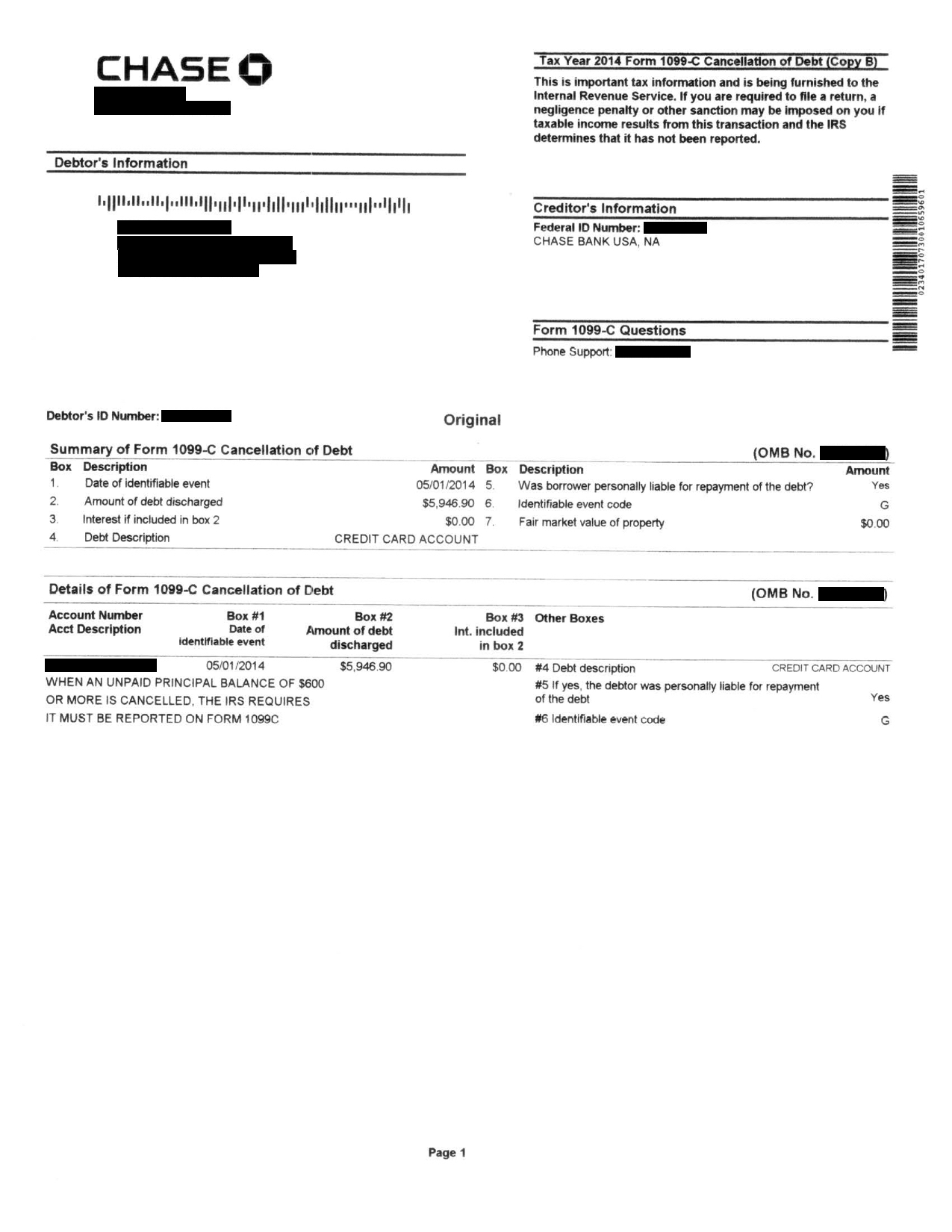

Charles MO for a onetime payment of 6000 against a 26000 Chase credit. How to Negotiate a Chase Credit Card Settlement Step 1. Client had 1 account totaling 2753734.

Chase Bank USA Credit Card Debt Settlement Settlement Structure. Offer a lump sum settlement If you have access to a good amount of cash or can put it together fairly quickly you can try to negotiate a settlement with the credit card company in three payments or less creditors are precluded from offering better than three-month terms if your account has not yet been charged off. Chase has settled with several customers at a final amount of 30 to 60 percent of the original debt.

JPMorgan Chase Co. If you do enroll in the plan be sure to inquire whether the 30-60-90 day late payment notations will be brought current on your credit report. Decide if you want to pursue do-it-yourself debt settlement or hire a debt settlement company to negotiate on your.

If you can swing the payment the reduced interest hardship monthly repayment plan is a good program for you. Determine if you have enough money to pay the debt in a lump sum. You can do this by looking at your Chase credit card.

Choose from our Chase credit cards to help you buy what you need. Plus get your free credit score. Think about answers to questions about your income your.

The bank is forgiving your balance. We can help you find the credit card that matches your lifestyle. A debt settlement is a negotiation between you the credit card borrower and Chase that you will pay back a reduced amount of the debt that you owe rather than the full amount.

If youre an owner of a Chase Canadian credit card theres good news. How to Settle Chase Credit Card Debt. Chase offers other assistance programs as well to customers who are faced with a hardship.

For a free debt consultation visit httpwwwgame. When settling credit card debt with Chase Bank and collectors for them know that they deal with delinquent accounts differently than other creditors. Paul Hartwick spokesperson for Chase told me Chase will not work with debt settlement companies.

Chase Bank has agreed to pay 115 million to settle a class action lawsuit alleging the bank harmed credit card accountholders credit scores and even required them to pay on debts that were discharged in Chapter 7 bankruptcy. Figure out how much money you owe on your credit card. Citi offered a debt settlement program at 55 of about 9000 in unpaid credit card debt and allowed the payment to be made over 12 months.

Reach out to Chase. Click here to learn more on credit card hardship programs from Chase. Debt settlement with Chase - Pre Charge Off.

There are many benefits of debt settlement for credit card debt to get out of credit card debt. We have negotiated a settlement with a collection agency called Client Service Inc. Rehearse your conversation if youre doing the negotiating.